Mera Pakistan Mera Ghar is now offered as Easy Home by Meezan bank. The low-cost Housing Finance Scheme is a convenient and affordable scheme offered under the PM’s Naya Pakistan Housing Scheme.

![Meezan Bank Easy Home: Mera Pakistan Mera Ghar [Guide]](https://www.incpak.com/wp-content/uploads/2020/11/124647412_431959894460965_162894700259982731_n.jpg)

Meezan Banks’ Easy Home is a completely Shariah-compliant way using Diminishing Musharakah mode of financing.

Meezan Easy home is Islamic Home finance which is completely interest (Riba) free. The customers will be in joint ownership of the property through Diminishing Musharakah. By this Meezan Bank will share in the cost of the house being purchased.

The Bank will provided a certain amount of financing and the applicant will agree to pay in monthly installments. The applicant will only become a sole owner after clearing all the amount in due course of time.

Read more: Mera Pakistan Mera Ghar Loan Application [Complete Information].

Table of contents

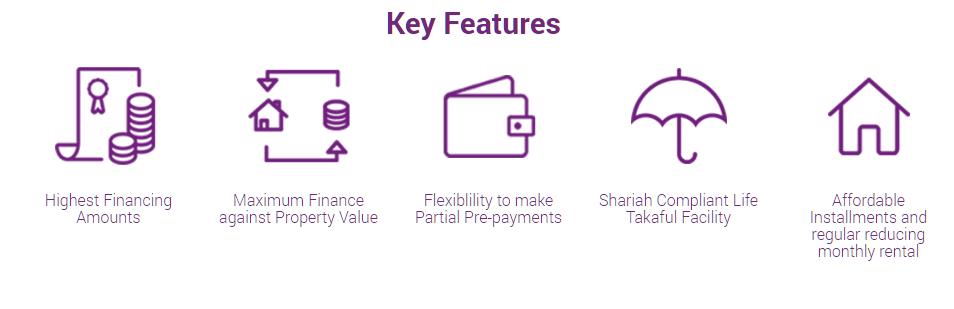

Product Features and Benefits

| Tiers | Size of Housing Unit | Max. Price of Housing Unit | Max. Financing | Min. Contribution from Customer | Rental Rate |

| Tier 1 (T1)(NAPHDA Projects) | House Unit/Apartment of upto 125 sq. yd. (upto 5 Marla) with covered area of upto 850 sq. ft. | Rs.3.5 million | Rs. 2.7 Million | 10% of property value | 5% (fixed) for first 5 years and 7% (fixed)for next 5 years. For period exceeding 10 years = 1 year KIBOR+2.5% |

| Tier 2 (T2)(Non-NAPHDA Projects) | House Unit/Apartment of upto 125 sq. yd. (upto 5 Marla) with covered area of upto 850 sq. ft. | Rs.3.5 million | Rs.3.0 million | 10% of property value | 5% (fixed) for first 5 years and 7% (fixed)for next 5 years. For period exceeding 10 years = 1 year KIBOR+4% |

| Tier 3 (T3)(Non-NAPHDA Projects) | House Unit of more than 125 sq. yd. (10 Marla) or Apartment with covered area from more than 850 sq. ft. to 1,100 sq. ft. | Rs.6.0 million | Rs. 5.0 million | 15% of property value | 7% (fixed) for first 5 years and 9% (fixed) for next 5 years. For period exceeding 10 years = 1 year KIBOR+4% |

Financing : For Ten, fifteen and twenty years, depending upon choice of customers.

Basic Eligibility Criteria

- Citizenship: All Pakistani Nationals holding CNIC.

- Home Owner: First-time homeowner, one unit per household.

- Housing Finance Facility: An individual can have a subsidized housing finance facility under this scheme only once.

- Unit to be financed: Only for construction and first purchase of newly constructed affordable housing units.

- Collateral Security Requirement: For NAPHDA Projects – Trust will be responsible for the title documents. For Non-NAPHDA Projects – As per Banks’ credit policy and prudential regulations for housing finance, the financed housing unit will be mortgaged in favor of the financing bank.

- Age: Primary Applicant – Minimum 25 years & maximum 65 years at financing maturity. Co-applicant – Minimum 21 years & Maximum 70 years at financing maturity. (Incase of salaries person, applicant and co-applicant financing maturity should ot exceed the date of retirement. In case of businessman, required co-applicant’s maximum age at financing maturity is 65 years – if business incoe is clubbed – and 70 years if business income is not being clubbed.)

- Customer/Applicant: Primary (or Single) & Co-applicant allowed. Co-applicant must be an immediate family member.

- Income: Salaried – Minimum Gross Income of PKR 40,000 per month. 100% co-applicant income may be clubbed in case of spouse only. Self-employed/business Person – Minimum Gross Income of PKR 75,000 per month.

- Employement Tenure: Salaried – Permanent job with a minimum 2 years continuous work history in the same industry/feild. Self-employed/Business Person – Minimum 3 years in current business / industry.

Application Form

To download application for clink the link below:

Required Documents

Documentation Requirement – Salaried Segment

- Loan Application Form (LAF) along with CF Undertaking – Original

- Product Disclosure Sheet – Original

- Valid CNIC of applicant & Co-partner (where applicable) – Copy

- 2 Passport size Color Photographs of applicant & Co-partner (where applicable) – Original

- Undertaking for the first-time homeowner – Original

- Proof of allotment, transfer, and/or Title Document of the property to be

- mortgaged – Copy

- Direct Debit Authority (DDA) & Employer’s certificate mentioning that payroll account maintenance shall continue with the lending Bank (where applicable) – Original

Formal Sector Employees

- Proof of Employment (along with the length of employment) for example:

Employment letter OR Employment Certificate OR Any valid documentary evidence from the employer

Original / Copy - Income Proof document (salary breakup and deductions to be clearly

mentioned) for example Current Salary Slip (original/copy) OR Salary Certificate (original) OR Account Maintenance Certificate along with last 6-month Bank statement with Salary Credits. (Original)

Notes: - Maximum of 60 days old salary slip & Bank Statement may be accepted

- Online / e-salary slips are acceptable with positive verification

- Original salary slip / e-slip does not require a stamp or sign.

Informal Sector Employees

In case the customer is employed in the informal sector, one of the following documents shall be required to assess the customer based on proxy income or repayment surrogates, for example:

- Rent Agreement (Copy) OR

- Rent Payment declaration (Original) OR

- Utility Bills (Copy) OR

- Telco Bill (Copy) OR

- School Fee Challan (Copy) OR

- Any other valid expense document (as per defined Income proxy) (Copy)

Documentation Requirement – Self Employed

- Loan Application Form (LAF) along with CF Undertaking – Original

- Product Disclosure Sheet – Original

- Valid CNIC of applicant & Co-partner (where applicable) – Copy

- 2 Passport size Color Photographs of applicant & Co-partner (where applicable) – Original

- Undertaking for the first-time homeowner – Original

- Proof of allotment, transfer, and/or Title Document of the property to be

- mortgaged – Copy

Formal Sector Self Employed

Proof of Business (stating ownership and length of business) for example:

- Partnership Deed OR – Copy

- Bank Certificate for Sole Proprietor / Partnership OR – Original

- NTN Certificate OR – Copy

- Rent agreement of office OR – Copy

- Professional Degree / Diploma &/OR Valid Membership if applicable

Professional body OR – Copy - Any other valid acceptable business document verifiable from authority

fulfilling the minimum business tenor requirement. Copy/Original

Income assessment document

Account Maintenance Letter along with at least recent 6 months Bank

Statement – Original

Notes:

- Maximum of 60 days Bank statement may be accepted

- Original Bank statement with bank stamp

Informal Sector Self Employed

In case customer is employed in informal sector, one of the following

documents shall be required to assess customer based on proxy income or

repayment surrogates, for example:

- Rent Agreement OR Copy

- Rent Payment declaration OR Original

- Utility Bills OR Copy

- Telco Bills OR Copy

- School Fee Challan OR Copy

- Any other valid expense document (as per defined Income proxy) Copy

Documents for Bank’s Internal Use

- Income Estimation / Repayment calculation sheet as per applicable proxy /surrogate Original

- Bureau Reports Original

- Residence / Workplace / Document Verification Report including collateral verification Original

- World-Check & NACTA checks Original

- NADRA Verysis Original

- Property Appraisal Report *Original

- Preliminary Legal Opinion * Original

- Final Legal Opinion * Original

- Shariah approved process flow Original

- Property Takaful Report * Original

- Mortgage Life Insurance / Takaful – Mandatory if borne by Government * Original

*Stage-ll documentation requirement

Notes:

- NAPHDA and/or the relevant financial institution(s) may require additional information as may be required by

NAPHDA or any other law/regulation. - The above list of Documentation Requirements for Salaried and Self Employed are relevant to the application

stage of end-user mortgage financing. The documentation requirements and legal formalities to be fulfilled,

after the facility application has been approved by the relevant financial institution(s), such as legal

documentation required to be stamped, signed, and witnessed at the time of signing of /disbursement, maybe

prescribed separately

Download the copy of the list of documents needed by Meezan bank click the link below:

Payment Plan

Approximate monthly payments*

| Financing amount | Rs. 10 Lakhs | Rs. 20 Lakhs | Rs. 30 Lakhs | Rs. 40 Lakhs | Rs. 50 Lakhs |

| Monthly payment | 6,600 | 13,199 | 19,799 | 31,012 | 38,765 |

(Monthly payments mentioned above are for the first five years, based on 20 years financing period.)

*Terms & conditions apply.

Frequently Asked Questions—Markup Subsidy Scheme for Housing Finance

- Can financing under the facility be utilized for the purchase of the plot?

A plot of land can only be purchased under the facility if a

house is to be constructed on the plot and financing is

meant both for purchase of land and construction

thereon provided all other terms and conditions of the

facility including a maximum price of house and maximum

loan under the relevant tier is complied with. - How can the first time homeownership be established?

In order to establish first-time homeownership, financing

the bank will obtain an undertaking to the same effect from

its borrower/customer with necessary provisions for

termination of subsidy and other penalties, in case it is

established at a later stage, that the borrower/ customer

owned a house at the time of application for availing

subsidy facility. - Is the financing also available for the purchase of flat?

Yes, financing will be available for the purchase of a flat which

meets covered area requirements specified for ‘apartment’ under the Facility. - Is the financing for expansion/extension in the existing housing unit allowed?

Yes, financing will be available for expansion/extension of existing housing unit provided the housing unit after expansion/extension falls within the criteria specified under the facility. - Can financing under the scheme be utilized for the renovation of the

existing residential unit?

No, financing for the renovation of existing housing unit will not be allowed under the facility. - Is bank staff eligible to avail the financing under this facility?

No, bank staff is not eligible under the facility - What does a new house mean? New house/ apartment/ flat means a unit, not more than 1 year old from he date of application, as established by Completion Certificate.

- What does the first purchase mean? The first purchase means the first transfer of the house/ apartment/ flat.

- How much income of co-borrower can be clubbed and how many co-borrowers/applicants are allowed?

In the case of co-applicants, 100% income of co-applicants may be clubbed for credit assessment. Up to four co-applicants are allowed for a single housing unit. - While availing of the markup subsidy, is it allowed to sell or rent out the residential unit?

Homeowners will not be allowed to sell the housing unit before the xpiry of 5 years from the date of acquisition. Further, during this period, he/she will not be allowed to rent out the financed housing unit. - What is the difference between Tier 1 (T1) and Tier 2 (T2)?

The residential units announced by NAPHDA fall under Tier 1 (T1). All other residential units with the same specifications/measurements fall under Tier 2 (T2). - What would be the size of housing units under Tier 3 in terms of Marla?

Housing units under Tier 3 are required to be greater than 5 Marla but up to 10 Marla. - In case the plot size of the housing unit is 5 Marla but the covered area is more than 850 square feet, what would be its classification in terms of Tiers defined in the scheme?

The housing units of up to 5 Marla with a covered area of more than 850 square feet and up to 1,100 square feet will be covered under Tier 3 (T3). - What Loan-to-Value (LTV) ratio should be observed while extending financing under the scheme?

The housing finance under Tier 1 and Tier 2 shall be provided at a maximum LTV ratio of 90:10 whereas it is 85:15 for Tier 3. - Will the markup subsidy be available even after the loan is classified as a loss?

Markup Subsidy will be discontinued on the categorization of a loan as “Loss”. - Is unequal monthly installment for the repayment of loans allowed under the scheme?

The repayment of financing under this Facility will be in equal monthly installments. - Will there be any prepayment penalty?

In the case of early payment, banks will not charge a penalty to the customer. - Which KIBOR shall be used for loan pricing?

The KIBOR used for pricing will be One Year KIBOR to be reset every year. - Is the pricing spread for banks mentioned in the scheme fixed for

each Tier?

The spread mentioned in the scheme for each Tier is the maximum spread. Banks may opt for less spread. - Can banks obtain documents in addition to the checklist provided by

PBA?

The financing banks will not require borrowers to provide documents in excess of the standard checklist of documents circulated by the Pakistan Banks’ Association.

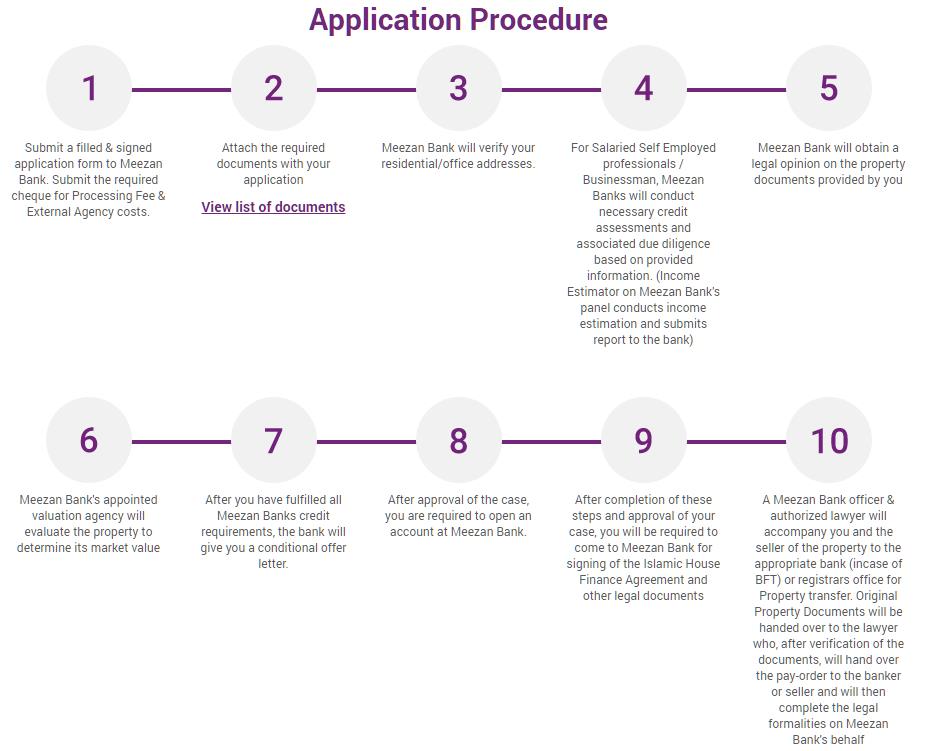

Application Process

Also Check the Mera Pakistan Mera Ghar ‘Naya Pakistan Housing Scheme’ Loan facility by other banks

this is alwsome

Assalam-O-Alaykum sir,

By profession I am a lecturer, serving in Higher Education Department KP for two years, and want to apply for an easy home loan. can I apply???? am I eligible to avail this service???

Dear Sir, You need to visit Meezan Bank for more information, we are not updated about government employees information but to my knowledge, I think meezan bank will be able to guide you properly.