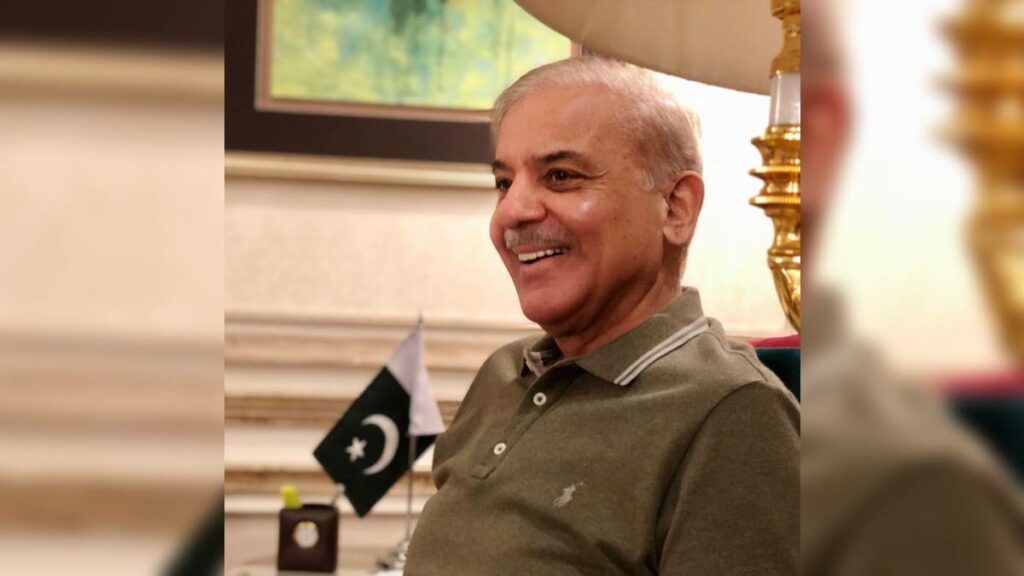

Prime Minister Shehbaz Sharif on Friday announced the imposition of a 10 percent ‘super tax’ on large-scale industries to boost revenue. According to the premier, the ‘super tax’ will be used for poverty alleviation in order to support the burden of inflation on the masses.

The super tax will be applicable on large-scale manufacturing like oil, gas, steel, sugar, cement, fertilizers, LNG terminals, banking, textile, automobile, cigarettes, chemicals, and beverages. Furthermore, the premier added that decision was made to save the common man from taxes.

Prime Minister Shehbaz Sharif also announced the imposition of another tax on those citizens earning an annual income of Rs. 150 million or higher. According to the premier, those earning Rs. 150 million will have their tax rate increased by 1%, while those earning Rs. 200 million will have their tax rate increased by 2%.

Meanwhile, those individuals with annual income of more than Rs. 250 million will have their tax rate increased by 3% and those with earnings of Rs. 300 million will have their tax rate increased by 4%. While announcing these increased taxes, the premier said “that rich would have to do their part” to alleviate the burden of inflation from the poor.

“Those who are blessed today must come forward and make Pakistan prosperous and progressive,” he added. Prime Minister Shehbaz Sharif further said that upcoming budget would be the “first in history” that aimed at lessening the burden on the poor segment of society.

Moreover, the Prime Minister said that incompetence of the former Pakistan Tehreek-e-Insaf (PTI) Government had destroyed the country. However, he assured that economic conditions would improve and confidence in the economy would be restored.

Talking about the International Monetary Fund (IMF) $6 billion bailout package, the premier said that negotiations with the financial watchdog had been completed and the body had no more requirements. “We have taken decisions that will prove difficult in the short run but in the long run they will pay off,” he added.

Miftah Ismail Clarifies Super Tax

Finance Minister Miftah Ismail took to Twitter to clarify the imposition of super tax imposed on large scale industries. He said “the super tax of 4% will be applicable to all sectors. But for the specified 13 sectors, another 6% will be added for a total of 10%.”

The minister added this would bring the tax rates from 29% to 39% and the one-time tax would help curtail the previous four record budget deficits.

Just to clarify: the super tax of 4% will be applicable to all sectors. But for the specified 13 sectors, another 6% will be added for a total of 10%. So their tax rates will go from 29% to 39%. This is a one-time tax needed to curtail the previous four record budget deficits.

— Miftah Ismail (@MiftahIsmail) June 24, 2022

Read more: PMD Forecasts Hot & Dry Weather in Most Parts of Pakistan.