The UAE Federal Tax Authority (FTA) recently revealed a new guideline that outlines the criteria to determine which residents are affected from the Corporate Tax Law, which officially kicked in on June 1, 2023.

This guideline is specifically designed for individuals pulling in income in the UAE, helping them navigate the landscape and see if they fall under the Corporate Tax umbrella.

The FTA is really urging all the relevant individuals out there – especially those raking in cash in the UAE or dabbling in business, be it full-time or part-time – to give this new guide a read. It’s a goldmine for understanding the ins and outs of the Corporate Tax Law, its nitty-gritty decisions, and other useful materials you can find on the FTA’s official website.

And they’re not just saying skim through it; they want you to really get into the guide, cover to cover. It’s packed with all the info you need to stay on the right side of things, complete with definitions to make it crystal clear. Plus, there are real-world examples that show how the Corporate Tax Law plays out for individuals doing business in the UAE, no matter if you’re a local or an international player.

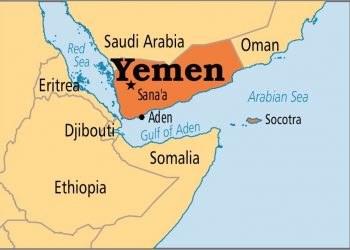

As for the specifics, the guide lays it out – non-resident individuals might find themselves in the corporate tax mix if they’ve got a permanent gig in the UAE, pulling in over Dh1 million in total turnover within a calendar year, starting from 2024. So, it’s worth a read to stay in the know and on the right side of the tax game.