How to pay car token tax in Pakistan depends on the province you live in and the engine size of your car. In most cases, you’ll need to pay it annually to avoid penalties. Luckily, the process has been simplified in recent years. Each province allows you to use designated mobile apps or the Excise and Taxation Department’s website to renew your car token tax online. This article will provide a comprehensive guide on how to do this for various provinces in Pakistan.

What is Car Token Tax?

Every year, Pakistani provinces collect a vehicle token tax through their Excise and Taxation Departments. This fee applies to all registered vehicles and helps fund the maintenance of roads, bridges, and other transportation infrastructure. Understanding the different payment methods for your province is key to a smooth renewal process.

Renewal Procedure in Punjab

In Punjab, car owners can conveniently renew their vehicle token tax online through ePay Punjab. First, they need to register their vehicles online via motor vehicle registration providers. Verification of vehicle registration status can be done through the official MTMIS website or by sending an SMS to 8785. Alternatively, they can visit excise and taxation offices or authorized bank branches for over-the-counter payments.

How to Pay Car Token Tax in Punjab?

- Download the Punjab e-Pay App on your phone from the App Store or Google Play Store.

- Open the app and look for the “Taxes” section or a similar category.

- Within Taxes, you’ll likely find an option for “Token Tax.”

- You might need to register for an account within the app if you haven’t already done so.

- Enter your vehicle registration number or any other details requested by the app to access your vehicle information.

- The app should display the outstanding token tax amount.

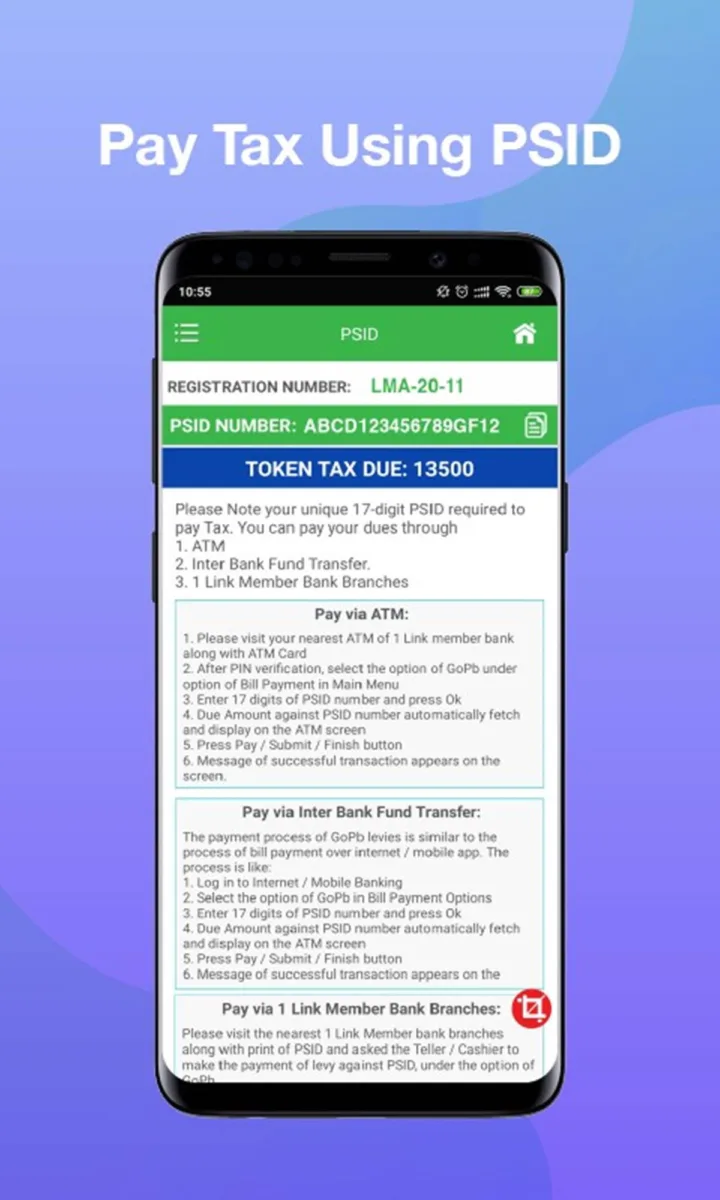

- Proceed to generate a PSID (Payment System Identifier) number. This unique 17-digit number is used for the payment.

- You won’t pay directly through the Punjab e-Pay App itself.

- The generated PSID can be used for various payment channels:

- Internet Banking

- Mobile Banking

- ATM (Automated Teller Machine)

- OTC (Over The Counter) banking at a bank branch

- Mobile Wallets

- TELCO Network Agent locations (franchise shops of telecom companies)

- Choose your preferred payment method and use the PSID number to complete the payment process.

Token Tax Renewal Procedure in Sindh

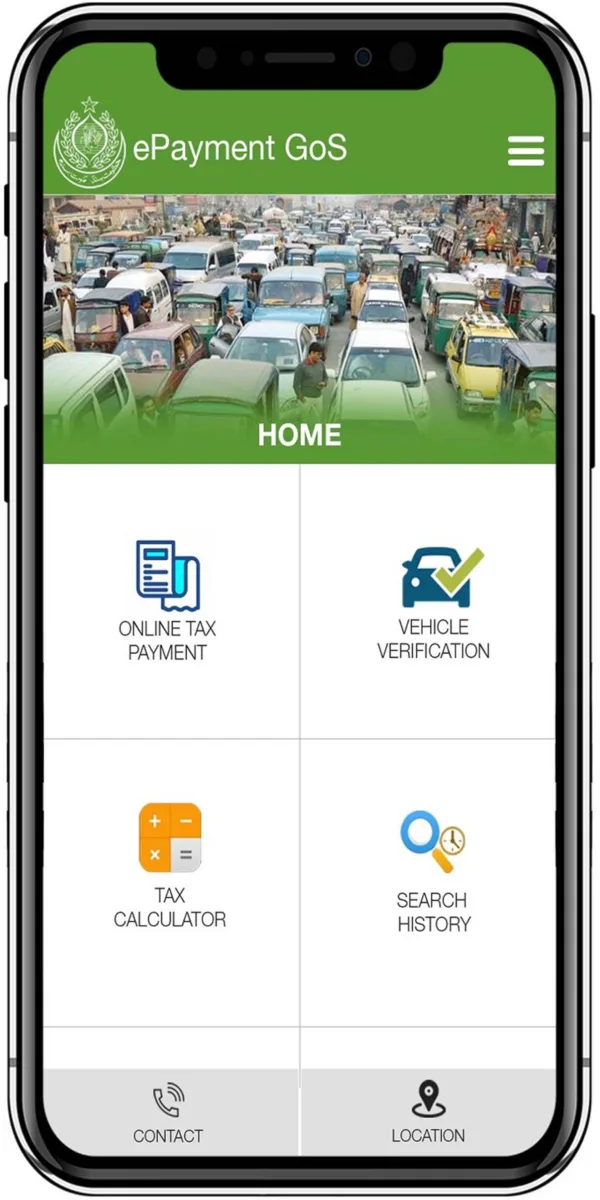

In Sindh, car owners can use the e-payment GOS app for online vehicle token tax payments, eliminating the need to queue up at offices. Verification of token tax dues can be done through the Sindh excise and Taxation Department’s online service. Payment methods include debit/credit cards, bank branches, or Sindh Revenue Authority (SRA) facilitation centers.

How to Pay Car Token Tax in Sindh?

- Download the e-Payment GOS app on your phone from the App Store or Google Play Store.

- Go to the Quick Tax Payment Option.

- Provide required vehicle details.

- Scroll to the bottom and it will show you outstanding tax amount.

- Generate a PSID and pay your tax through your banking app or through ATM.

Renewal Procedure in Islamabad

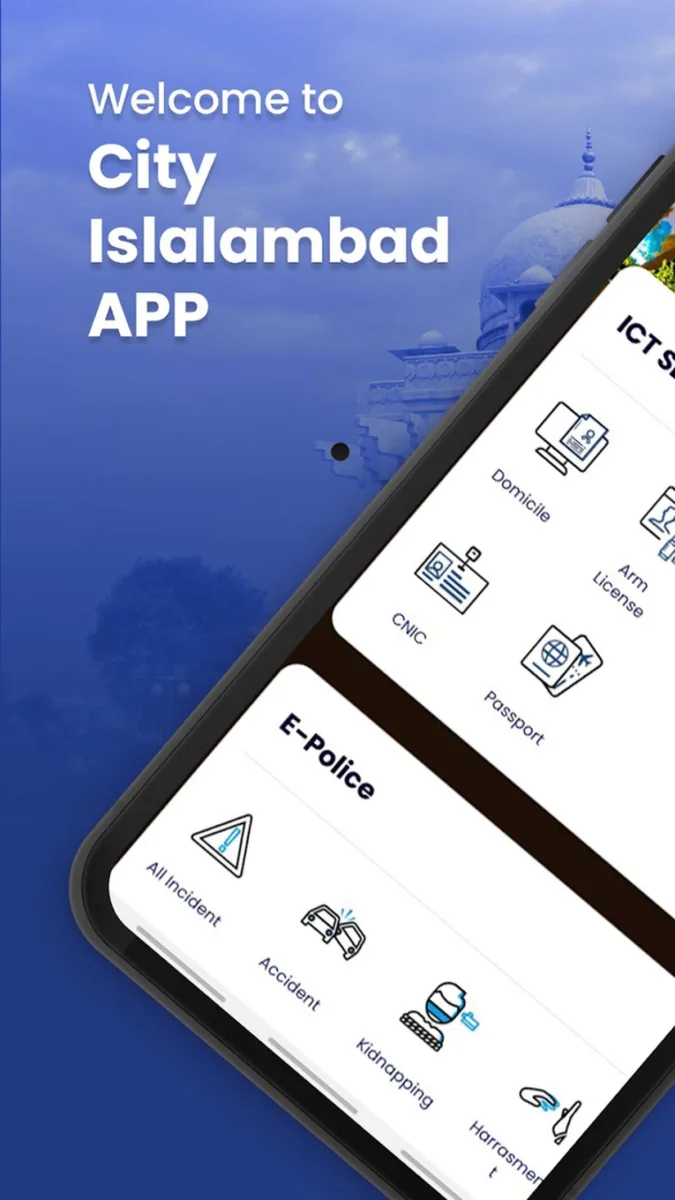

Islamabad residents can conveniently renew vehicle token tax through the City app or MTMIS Islamabad. After registering vehicles online, payments can be made through the app or by visiting designated bank branches. Manual payments can also be made at excise and taxation department offices.

How to Pay Car Token Tax in Islamabad?

- Download and install the Islamabad City App on your phone from the App Store or Google Play Store.

- Open the app and navigate to the “Excise and Taxation” section.

- Look for the “Token Tax Payment” option.

- You might need to register yourself within the app if you haven’t already.

- Enter your vehicle registration number or any other details requested by the app to find your vehicle information.

- The app should display the outstanding token tax amount.

- Proceed to the payment section.

- Choose your preferred payment method and complete the payment process.

Renewal in KPK

In Khyber Pakhtunkhwa (KPK), token tax renewal can be completed through the official excise and taxation website or designated bank branches. Manual payments can be made at excise and taxation department offices throughout the province.

Payment through Banking Apps

Car owners can also utilize banking apps for online token tax payments. After logging in, they can select the tax payment option, enter vehicle details, choose a payment method, and receive confirmation. It’s essential to retain the payment receipt as proof.

Renewing car token tax online offers convenience and efficiency for Pakistani car owners. Timely renewal is crucial to avoid penalties and legal issues. For assistance, individuals can reach out to the respective excise and taxation departments. With diverse payment methods available, fulfilling token tax obligations has become more accessible than ever before.

Read More: Vehicle Verification Online 2024 – Islamabad, Punjab, Sindh & KP

Follow INCPAK on Facebook / Twitter / Instagram / YouTube for updates.