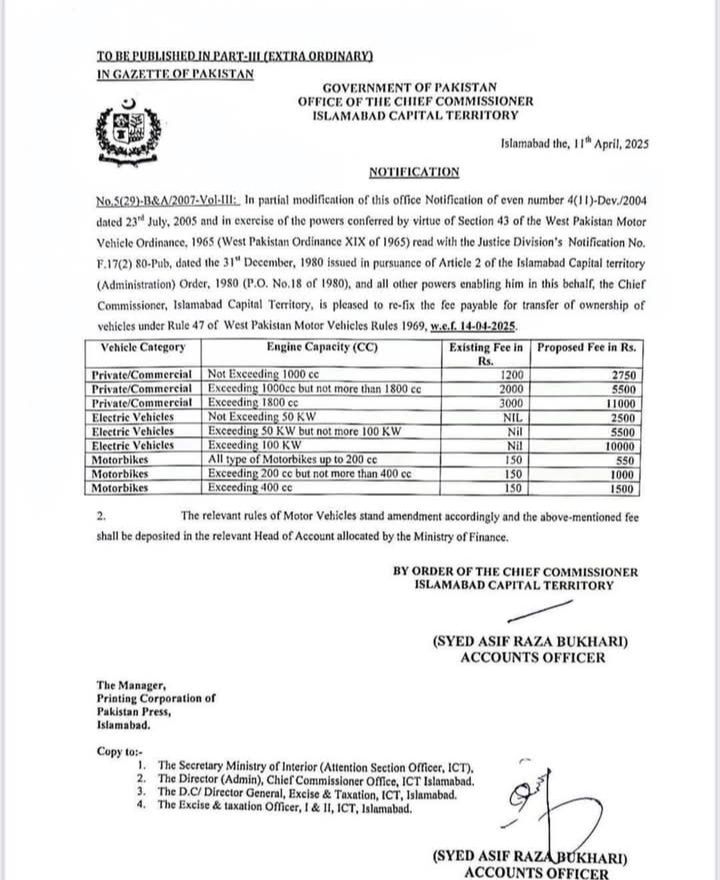

The Office of Chief Commissioner of the Islamabad Capital Territory (ICT) just released a new notification on April 11, 2025, revising the vehicle transfer fees in Islamabad.

This update changes the fees for transferring ownership of different types of vehicles under Rule 47 of the West Pakistan Motor Vehicle Ordinance, 1965.

These rules have been around for a while, but the fees were last updated in 2004, so this is a big change.

| Vehicle Category | Engine Capacity/Power | Existing Fee (Rs.) | Proposed Fee (Rs.) |

|---|---|---|---|

| Private/Commercial | Not exceeding 1000 cc | 1200 | 2750 |

| Private/Commercial | Exceeding 1000 cc but not more than 1800 cc | 2000 | 5500 |

| Private/Commercial | Exceeding 1800 cc | 3000 | 11000 |

| Electric Vehicles | Not exceeding 50 kW | Nil | 2500 |

| Electric Vehicles | Exceeding 50 kW but not more than 100 kW | Nil | 5500 |

| Motorcycles | Not exceeding 200 cc | 150 | 1000 |

| Motorcycles | Exceeding 200 cc but not more than 400 cc | 150 | 1500 |

| Motorcycles | Exceeding 400 cc | 150 | 1500 |

Updated Vehicle Transfer Fees in Islamabad (Effective April 11, 2025)

The money from these fees will go into a special account managed by the Ministry of Finance, as per the rules. This change is meant to update the costs to match today’s economy, since the last update was over 20 years ago.

If you’re planning to transfer a vehicle soon, keep these new fees in mind, The new transfer fees are effective from 14th April, 2025.

For more details, visit Islamabad Excise and Taxation Department official website.

Make sure to have all your paperwork ready when you go to transfer your vehicle—it’ll make the process much smoother