Since its launch of Refinance Scheme to Support Employment and Prevent Layoff of Workers, called Rozgar Scheme in common parlance, State Bank has been constantly receiving feedback from various stakeholders, making the scheme more facilitative for businesses and creating incentives to prevent layoff of employees under current COVID Pandemic scenario. Many of the changes in the scheme were carried out to ensure that the benefits of the scheme particularly reaches to the SMEs that offer employment to a large number of people. In this regard, recently announced Government’s risk sharing facility and allowing corporate guarantees as collateral are expected to incentivize banks in extending loans to collateral deficient SMEs. Now taking another step further to facilitate middle and large

businesses, which employ large numbers of people, to ensure payment of wages and salaries under this scheme, SBP has decided to enhance its refinance limits announced earlier.

Read More: SBP to NOT issue Fresh Bank Notes on Eid-ul-Fitr 2020

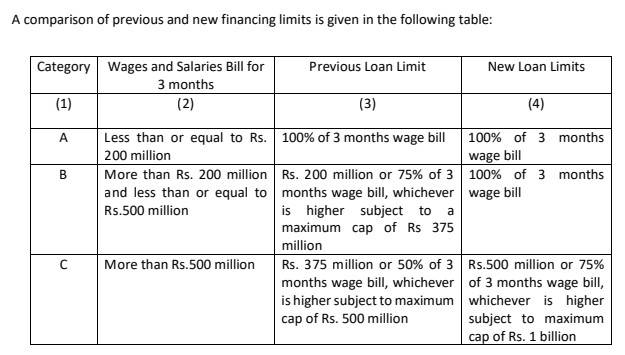

Hence, State Bank will now finance up to 100% of wages and salaries of businesses with average 3-month wage bill of up to Rs500 million (see table below). This can be used for the onward payment of wages and salaries for the months of April, May and June, 2020. Earlier, 100% financing was available up to a wage bill of Rs200 million only. Similarly, for businesses with 3-month wage bill exceeding Rs500 million, State Bank will now finance of up to 75% with maximum financing of Rs1 billion. Earlier,

75% financing was available up to a maximum of Rs375 million and 50% up to a maximum of Rs500 million. The above changes are applicable with immediate effect. However, businesses that had earlier availed lower financing due to applicable limits can now avail additional financing on the basis ofrevised criteria. Further details on this measure are available in the SBP circular available at: http://www.sbp.org.pk/smefd/circulars/2020/CL10.htm

This increase in financing limits along with Government’s risk sharing facility for collateral deficient SMEs and small corporates will enable the full array of businesses to benefit from SBP’s Rozgar Scheme and hence prevent large scale lay offs. Further, State Bank has also extended the availability of its refinance scheme to non-deposit taking financial institutions as well. They can now avail financing under the scheme for payment of wages and salaries of their employees.

Since the launch of the scheme till May 08, 2020, banks have received requests of more than 1,440 businesses for the financing of over Rs. 103 billion for providing wages and salaries to around one million employees whose jobs have been supported because of this scheme. Of this amount, banks have already approved financing of Rs 47 billion for 500 companies covering over 450,000 employees

A complete list of the measures taken by the SBP to support the economy and public health since the outbreak of COVID-19 is available at: http://www.sbp.org.pk/corona.asp. If end-users would like further information on these SBP measures in the context of COVID-19 or if they are experiencing issues with commercial banks in benefiting from these measures, they can contact a dedicated COVID-19 SBP team by email at covid19 stimulus@sbp.org.pk or by phone at 111-727-273.

End-users are encouraged to review the material available at the above webpage including relevant circulars and any available FAQs before contacting the SBP for further information.

Read More: SBP to NOT issue Fresh Bank Notes on Eid-ul-Fitr 2020