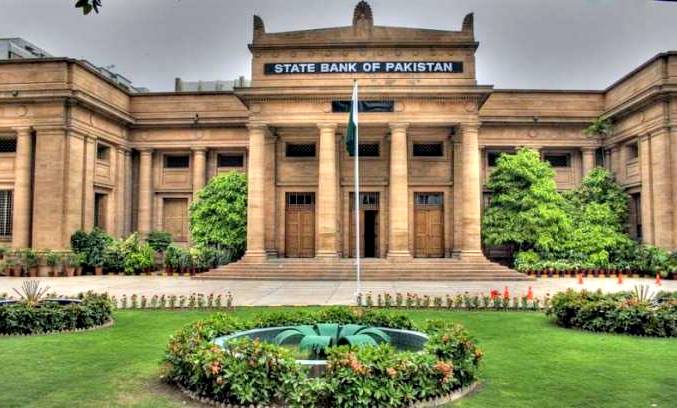

KARACHI: The State Bank of Pakistan has extended the Rozgar Scheme for next three months to support employment till 30 September 2020.

Under the Rozgar Scheme businesses can obtain financing to pay wages and salaries for maximum period of six months starting April 2020. This has been done so that businesses do not have to lay off their workings during the coronavirus pandemic and are able to cover wages for another three months.

Read more: Pakistan rupee falls, US dollar rises to all time high of Rs. 168.18.

Furthermore, according to the circular issued businesses who were not able to avail this facility having met all requirements will be able to apply for 6 months salaries and wages which include reimbursement for the previous months of April, May and June 2020. The circular can be found here.

Furthermore, the Government of Pakistan has extended the Risk Sharing Facility for next 3 months for SMEs enhancing their risk coverage from 40 percent to 60%. The following changed have been made according to circular to the Risk Sharing Facility for SBP Refinance Scheme:

| S. No | Particulars | Existing Key features | Revised Features |

| i | Eligibility | The financing extended to businesses with maximum sales turnover of Rs 2 billion, under SBP refinance scheme to support employment and prevent layoff of workers is eligible for Risk Sharing Facility by the GOP | Financing extended to SMEs and small corporates with maximum sales turnover of Rs 2 billion, under SBP refinance scheme to support employment and prevent layoff of workers is eligible for Risk Sharing Facility by the GOP. |

| ii | Risk Coverage | GOP will bear 40% first loss on disbursed portfolio (principal portion only) for eligible borrowers.Note: In case of non-repayments, after being classified as ‘Loss’ (as per the classification criteria laid down under respective SBP Prudential Regulations, credit loss subsidy claim will be paid by the GOP). | i) GOP will bear 60% first loss on disbursed portfolio (principal portion only) for eligible SME borrowers with turnover of upto Rs 800 million.ii) GOP will bear 40% first loss on disbursed portfolio (principal portion only) for eligible non – SME small corporates borrowers.Note: In case of non-repayments, after being classified as ‘Loss’ (as per the classification criteria laid down under respective SBP Prudential Regulations, credit loss subsidy claim will be paid by the GOP). |

| iii | Security Requirements | Security arrangements will be as per executing agency’s own credit policy after taking into account the factor of this risk sharing facility. Hence, banks are encouraged to facilitate collateral deficient borrowers. In any case, banks will not be asking for additional collaterals over and above 60% of the principal amount and markup thereon. | Security arrangements will be as per executing agency’s own credit policy after taking into account the factor of this risk sharing facility.Hence, banks are encouraged to facilitate collateral deficient borrowers. In any case, banks will not be asking for additional collateral over and above the non-guaranteed principal portion and markup thereon. |

| iv | Cut-off date | 30-06-2020 | 30-09-2020 |

Read more: Payoneer card funds to be accessible from 6 July 2020.