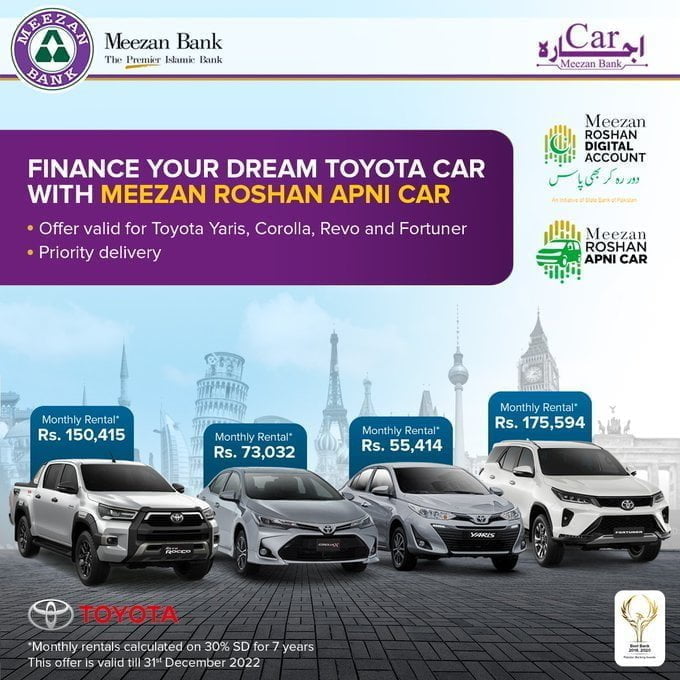

Meezan Bank Limited (MBL) has announced an installment plan for Toyota cars with priority delivery through the Roshan Apni Car for ‘Roshan Digital Account’ holders. According to the details, these account holders can now get Toyota Yaris, Corolla, Revo, or Fortuner at easy monthly installments with priority delivery.

For those concerned about interest, Meezan Bank’s car financing is interest-free is based on Islamic mode of financing called Ijarah (leasing). Meezan Bank’s Car Ijarah works through car rental agreement, under which the bank purchases a car and rents it out to the customer for a period of 1 to 5 years and upon completion of the said period, the vehicle will be sold off at the token amount or gifted to the customer.

Features of Meezan Bank Car Financing

- Lowest Up Front Payment

- Rental Payment starts after Vehicle Delivery

- Quick Processing Time

- Minimum Security Deposit as low as 30%

- Meezan Bank will bear With Holding Tax (WHT) on purchase of vehicle.

Meezan Bank Installment Plan For Toyota Cars

Right now, Meezan Bank has come out with an offer for Roshan Digital Account holders, who can avail their favorite Toyota car through Roshan Apni Car and enjoy priority delivery, which is very important since most customers have to wait several months after booking their vehicles.

Meezan Bank is offering the installment plan for the following Toyota cars:

- Toyota Yaris

- Toyota Corolla

- Toyota Revo

- Toyota Fortuner

Monthly Installments

| Toyota Car | Installment (Monthly Rental) |

|---|---|

| Yaris | Rs. 55,414 |

| Corolla | Rs. 73,032 |

| Revo | Rs. 150,415 |

| Fortuner | Rs. 175,594 |

However, it is pertinent to mention that above monthly rentals are calculated on 30% security deposit for 7 years and the plan can be modified based on customer requirements.

Eligibility Criteria

- Financing facility for new locally assembled and Complete Built Up (CBU) vehicles

- Security deposit / Advance rental: Minimum 15% and maximum 50% of the cost of vehicle

- Both data check & e-CIB should be clear and must not have default / overdue at the time of case approval

- The facility is available for all Roshan Digital Account holders including foreign currency account holders

- No processing charges. Documentation and security perfection charges are to be paid at actual by the applicant at the time of disbursement of the case

- Monthly Rentals are to be paid through direct debit instructions from PKR Roshan Digital Account

- The vehicle would be delivered to the nominee / co-borrower (blood relative – father / mother, son / daughter, brother/ sister or spouse residing in Pakistan) of applicant

- The maximum age of authorized nominee / co-borrower should not be above 70 years at the time of Ijarah maturity.

- In case of a non-filer, 4 % Advance Tax on the Cost of Vehicle will be applicable at the time of vehicle disbursement.

- Minimum age limit of applicant should be 25 years

- Maximum age limit of applicant at time of maturity should not exceed 60 years for salaried professional.

- Maximum age limit of applicant at time of maturity should not exceed 65 years for businessman / self-employed professional

- Minimum 2 years continuous employment history in current employment for salaried professionals.

- Minimum business experience 3 years continuous involvement in current business / industry for businessman / self-employed professional.

- If the applicant has availed other financing facilities, all monthly repayments combined, including proposed Ijarah rental, should not exceed 40% of net / take-home income

Required Documents

The following documents are required to avail Meezan Bank’s Car Financing:

Salaried Individuals

- Latest employment certificate including the date of joining

- Last six-month credited salary bank statement

- Nominee CNIC copy

- Name of employer’s HR representative with mailing address

- Credit Bureau Report of stay country

Businessman

- Valid business proof

- Last six-month verified bank statement through embassy

- Nominee CNIC copy

- Credit Bureau Report of stay country

- In case of remittances income, last six months bank statement of remitter would be required

However, there are some additional requirements for these individuals that have to be met for them to qualify for the Meezan Bank’s Car Installment Plan.

Salaried Professionals

- Permanent employees : 3 months in current job with a minimum 2 years continuous employment history

- Contractual employees : 6 months in current job with a minimum 3 years continuous employment history.

- Net take home income : In excess of 2 times the monthly rental (inclusive of takaful)

- Spouse’s verifiable income : Clubbed to an extent of 50%.

- In case of other loans, all monthly payments including proposed Ijarah rental combined not to exceed 40% of net / take home income

- Both data check & e-CIB should be clear and must not have current default / overdue at the time of case approval

Businessmen

- Minimum experience : 2 years continuous involvement in current business / industry

- Position : Proprietor, partner or director (In case of partner or director, percentage of sharing / holding will be applied)

- Net take home income : In excess of 2 times the monthly rental (inclusive of takaful)

- Spouse’s verifiable income : Clubbed to an extent of 50%.

- In case of other loans, all monthly payments including proposed Ijarah rental combined not to exceed 40% of net / take home income

- However upto 50% net/ take home income will be allowed for locally manufactures or assembled vehicles of up to 1000 CC engine capacity.

- Both data check & e-CIB should be clear and must not have current default / overdue at the time of case approval

For more details regarding Meezan Bank Car Financing, please refer to the bank’s official website at meezanbank.com/car-ijarah/ for details.

What do you think about Meezan Bank Installment Plan for Toyota Cars? Let us know in the comments section below.

Read more: Changan Alsvin Installment Plan With Priority Delivery Announced.

Follow INCPAK on Facebook / Twitter / Instagram for updates.