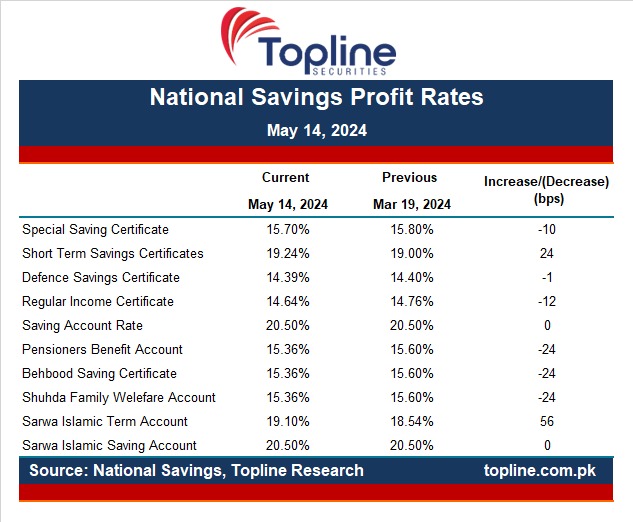

The government of Pakistan has announced changes to the profit rates on its various national savings schemes and certificates, effective May 14, 2024.

The profit rates on some of the most popular savings schemes, including Special Savings Certificates (SSCs), Regular Income Certificates (RICs), Pensioners Benefit Accounts (PBAs), Behbood Savings Certificates (BSCs), and Shuhada Family Welfare Accounts (SFWAs), have decreased.

The decrease in rates ranges from 1 basis point (bps) for Defence Savings Certificates (DSCs) to 24 bps for PBAs, BSCs, and SFWAs.

The profit rates on Short Term Savings Certificates (STSCs) and Sarwa Islamic Term Accounts (SITAs) have increased.

The increase in rates is 24 bps for STSCs and 56 bps for SITAs.

The profit rates on Saving Account Rates and Sarwa Islamic Saving Accounts (SISAs) remain unchanged.

The changes come after the Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) kept the key policy rate unchanged at 22% in April 2024. This was the seventh consecutive time that the MPC had kept the rate unchanged.