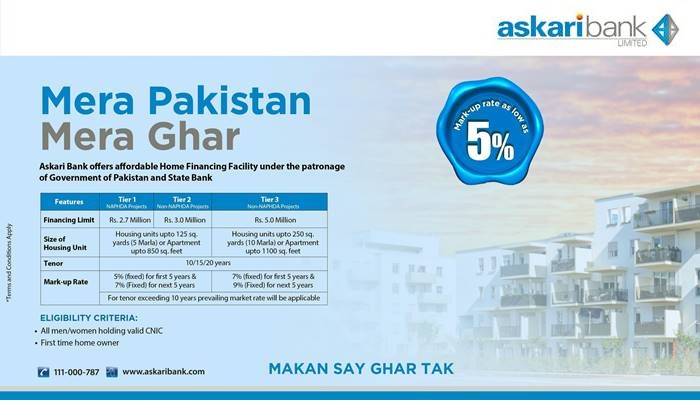

Through Askari Bank Mera Pakistan Mera Ghar people of Pakistan can achieve the dream of owning a house at a subsidized rate under of Naya Pakistan Housing Scheme.

All Pakistani nationals with valid CNIC can apply for the loan and finance a home. Askari Bank has designated 203 Branches to facilitate the people all across the country.

Like all other banks Askari bank is also offering Low Cost Home Financing under the guidelines provided by the State Bank of Pakistan and the Government of Pakistan.

Table of contents

Product Features

Eligible Customers

Salaried, Self Employed Individuals

Purpose of Finance

- First purchase of a newly constructed residential property (Apartment/Flat/House)

- Purchase of Plot + Construction

- Construction of housing unit on already owned plot

- Expansion/Extension of existing Housing Unit

(First purchase means first transfer of the house/apartment/ flat.

New house/ apartment/ flat means a unit not more than 1 year old from the date of application, as established by Completion Certificate)

Approved Cities

Whole of Pakistan

Eligibility Criteria

- All men/women holding CNIC

- First-time homeowner.

- The borrower must not have availed of housing finance previously from any Bank/DFI (as per latest eCIB/Data Check)

- One individual can have a subsidized house finance facility under the scheme, only once.

- Only for construction and first purchase of newly constructed affordable housing units.

Size of Housing Unit (Apartment/House)

| Parameter | Size of Housing Unit |

| Tier 1 (NAPHDA) | Housing unit/apartment of up to 125 square yards (up to 5 Marla) with a covered area of up to 850 square feet. |

| Tier 2 (Non-NAPHDA) | Housing unit/apartment of up to 125 square yards (5 Marla) with a covered area of up to 850 square feet |

| Tier 3 (Non-NAPHDA) | Housing unit/apartment of more than 125 square yards and up to 250 square yards (10 Marla) or covered area from more than 850 square feet to 1,100 square feet. |

Maximum Price of Unit

Maximum price (Market Value) of a single housing unit at the time of approval of financing, shall be as follows:

| Parameter | House Value |

| Tier 1 | PKR 3.5mn |

| Tier 2 | PKR 3.5mn |

| Tier 3 | PKR 6.0mn |

Financing Range

| Parameter | Loan Amount |

| Tier 1 | PKR 2.7mn |

| Tier 2 | PKR 3.0mn |

| Tier 3 | PKR 3.0mn |

Tenure of Loan

10/15/20 years, depending on choice of the customer

Subsidy Profit/Mark-up Rate

| arameter | End User Pricing (Subsidy Rate) | Bank Pricing |

| Tier 1 | First 5 Year 5% Next 5 Year 7% | 1 Year KIBOR + 250 BPS for a period exceeding 10 years |

| Tier 2 | First 5 Year 5% Next 5 Year 7% | 1 Year KIBOR + 400 BPS for a period exceeding 10 years |

| Tier 3 | First 5 Year 7% Next 5 Year 9% | 1 Year KIBOR + 400 BPS for a period exceeding 10 years |

Minimum Monthly Net Disposable Income/Take Home Income

| Permanent Salaried Employees including Govt. Employees/PensionersContractual EmployeesAverage Monthly Balance for Self Employed Individuals | Rs.40,000/-Rs.50,000/- Rs.100,00 |

Minimum Equity Requirements

Tier 1 – 10%

Tier 2 – 10%

Tier 3 – 15%

Processing Fee

Rs.6,000/-

Balloon Payment/Early Settlement Charges

Nil

Other Charges

Charges other than mark-up shall be applicable as per AKBL’s prevailing Schedule of Charges

Required Documents by Askari Bank

- Application Form (click here to download)

- Copy of Valid CNIC

- Salary Slip/Proof of Income

- Last 6 months Bank Statement

- Copies of Title Documents.

- Any other document required by the Bank.

Tentative Installments (20 Years) by Askari Bank

| Loan Amount | Tier | 1st 5 Years | Next 5 Years | > 10 Years |

| 1,000,000 | Tier-1 | 6,600 | 7,501 | 8,797 |

| 1,000,000 | Tier-2 | 6,600 | 7,501 | 9,483 |

| 1,000,000 | Tier-3 | 7,753 | 8,749 | 9,962 |

| 2,000,000 | Tier-1 | 13,199 | 15,002 | 17,595 |

| 2,000,000 | Tier-2 | 13,199 | 15,002 | 18,966 |

| 2,000,000 | Tier-3 | 15,506 | 17,497 | 19,923 |

| 3,000,000 | Tier-2 | 19,799 | 22,503 | 28,448 |

| 3,000,000 | Tier-3 | 23,259 | 26,246 | 29,885 |

| 4,000,000 | Tier-3 | 31,012 | 34,995 | 39,847 |

| 5,000,000 | Tier-3 | 38,765 | 43,744 | 49,808 |

Askari Bank Application Form

Designated Branches

Frequently Asked Questions—Markup Subsidy Scheme for Housing Finance

- Can financing under the facility be utilized for the purchase of the plot?

A plot of land can only be purchased under the facility if a

house is to be constructed on the plot and financing is

meant both for purchase of land and construction

thereon provided all other terms and conditions of the

facility including a maximum price of house and maximum

loan under the relevant tier is complied with. - How can the first time homeownership be established?

In order to establish first-time homeownership, financing

the bank will obtain an undertaking to the same effect from

its borrower/customer with necessary provisions for

termination of subsidy and other penalties, in case it is

established at a later stage, that the borrower/ customer

owned a house at the time of application for availing

subsidy facility. - Is the financing also available for the purchase of a flat?

Yes, financing will be available for the purchase of a flat that

meets covered area requirements specified for ‘apartment’ under the Facility. - Is the financing for expansion/extension in the existing housing unit allowed?

Yes, financing will be available for expansion/extension of existing housing unit provided the housing unit after expansion/extension falls within the criteria specified under the facility. - Can financing under the scheme be utilized for the renovation of the

existing residential unit?

No, financing for the renovation of the existing housing unit will not be allowed under the facility. - Is bank staff eligible to avail of the financing under this facility?

No, bank staff is not eligible under the facility - What does a new house mean? New house/ apartment/ flat means a unit, not more than 1-year-old from the date of application, as established by Completion Certificate.

- What does the first purchase mean? The first purchase means the first transfer of the house/ apartment/ flat.

- How much income of co-borrower can be clubbed and how many co-borrowers/applicants are allowed?

In the case of co-applicants, 100% income of co-applicants may be clubbed for credit assessment. Up to four co-applicants are allowed for a single housing unit. - While availing of the markup subsidy, is it allowed to sell or rent out the residential unit?

Homeowners will not be allowed to sell the housing unit before the xpiry of 5 years from the date of acquisition. Further, during this period, he/she will not be allowed to rent out the financed housing unit. - What is the difference between Tier 1 (T1) and Tier 2 (T2)?

The residential units announced by NAPHDA fall under Tier 1 (T1). All other residential units with the same specifications/measurements fall under Tier 2 (T2). - What would be the size of housing units under Tier 3 in terms of Marla?

Housing units under Tier 3 are required to be greater than 5 Marla but up to 10 Marla. - In case the plot size of the housing unit is 5 Marla but the covered area is more than 850 square feet, what would be its classification in terms of Tiers defined in the scheme?

The housing units of up to 5 Marla with a covered area of more than 850 square feet and up to 1,100 square feet will be covered under Tier 3 (T3). - What Loan-to-Value (LTV) ratio should be observed while extending financing under the scheme?

The housing finance under Tier 1 and Tier 2 shall be provided at a maximum LTV ratio of 90:10 whereas it is 85:15 for Tier 3. - Will the markup subsidy be available even after the loan is classified as a loss?

Markup Subsidy will be discontinued on the categorization of a loan as “Loss”. - Is unequal monthly installment for the repayment of loans allowed under the scheme?

The repayment of financing under this Facility will be in equal monthly installments. - Will there be any prepayment penalty?

In the case of early payment, banks will not charge a penalty to the customer. - Which KIBOR shall be used for loan pricing?

The KIBOR used for pricing will be One Year KIBOR to be reset every year. - Is the pricing spread for banks mentioned in the scheme fixed for

each Tier?

The spread mentioned in the scheme for each Tier is the maximum spread. Banks may opt for less spread. - Can banks obtain documents in addition to the checklist provided by

PBA?

The financing banks will not require borrowers to provide documents in excess of the standard checklist of documents circulated by the Pakistan Banks’ Association.

Mera Pakistan Mera Ghar By Other Banks

- UBL Ameen Mera Pakistan Mera Ghar Application Guide

- NBP Saibaan: Mera Pakistan Mera Ghar [Complete Guide]

- Meezan Bank Easy Home: Mera Pakistan Mera Ghar [Guide]

- Alfalah Ghar Asaan: Mera Pakistan Mera Ghar Loan – Bank Alfalah

- Faysal Tabeer: Mera Pakistan Mera Ghar Loan – Faysal Bank

- The Bank of Punjab – Mera Pakistan Mera Ghar