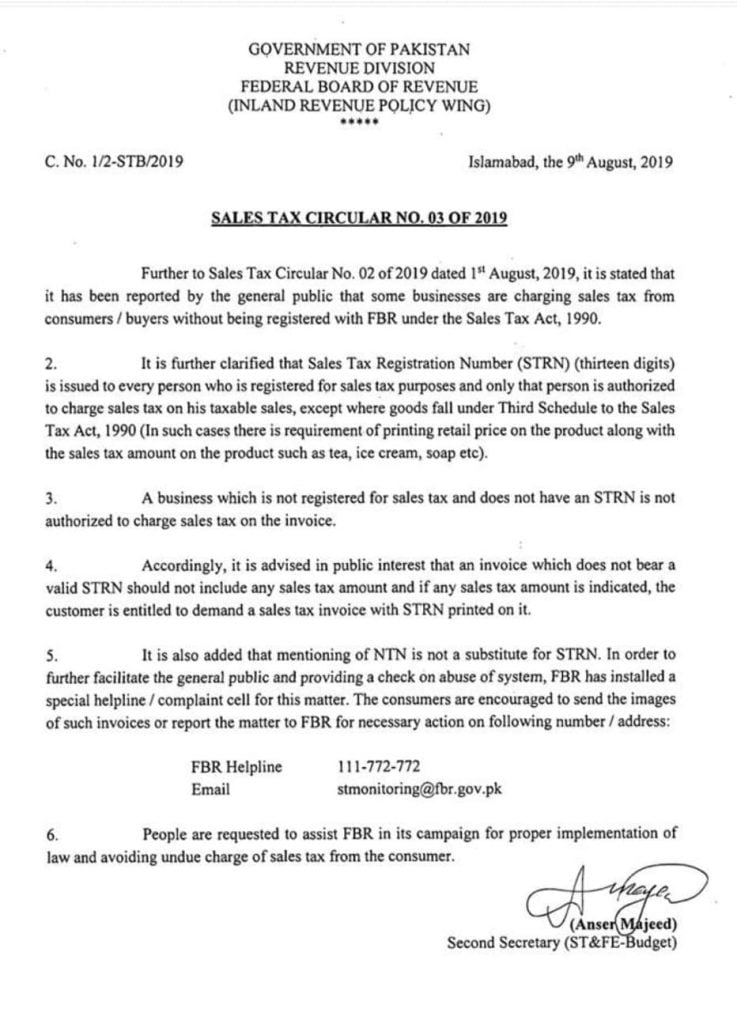

ISLAMABAD: Federal Board of Revenue (FBR) issued a Sales Tax Circular to aware consumers about undue overcharging by businesses those who are not registered yet.

FBR issued circular on 1st August 2019 stating that FBR has received complaints from customers/consumers of being over-charged by Businesses with no Sales Tax Registration Number (STRN).

According to the circular issued, FBR states “A business which is not registered for sales tax and does not have STRN is not authorized to charge sales tax on the invoice.“

To assist general public complaints, The Federal Board of Revenue (FBR) has issued UAN: 111 722 722 and email stmonitoring@fbr.gov.pk to report immediately along with the image of invoice.

FBR requests the public to help them implement law and avoiding the undue charge of sales tax.

FBR clarifies that National Tax Number (NTN) is not the substitute of STRN.

FBR Circular copy below

Read More: Another spell of heavy rain lashes Karachi