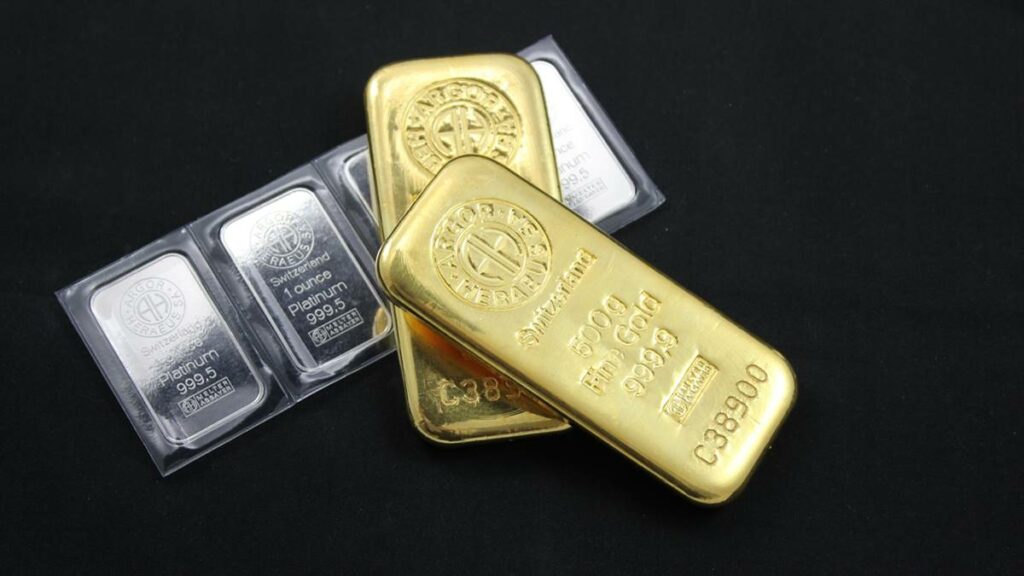

One of the most popular choices for wealth preservation in uncertain times for hundreds if not thousands of years is precious metals, with gold being the go-to option for many investors. However, silver and platinum are also gaining traction as viable safe haven investment alternatives.

Investment in gold has always been considered a safe investment because of its historical stability. It’s also seen as a hedge against inflation and currency devaluation during periods of economic uncertainty.

While gold prices can fluctuate, they more or less remain somewhat stable and can offer quick.

Read more: Why Gold Rates Fluctuate?

While platinum is known for its strength and resistance to wear and tear, is popular investments in the precious metals market, However, platinum being a dense metal is generally considered to be extremely durable compared with any other alloy. Platinum is resistant to scratching, and it maintains its luster and shine over time.

Gold vs Platinum

There are some key differences to consider when deciding which one to opt for between Platinum and Gold, which include:

- Platinum is rarer than Gold, making up only about 0.005% of the Earth’s crust. This rarity can drive up the pricing of platinum, making it more valuable than Gold in some cases.

- Platinum is more expensive than Gold, but it also has implications for higher returns.

- In the long-term, platinum prices have been administered to be more volatile than Gold, with more significant highs and lows.

- Gold the most attractive investment of all times as it is not dependent on any financial institute.

One of the most popular choices for wealth preservation in uncertain times for hundreds if not thousands of years is precious metals, with gold being the go-to option for many investors. However, silver and platinum are also gaining traction as viable safe haven investment alternatives.

Gold has always been considered as an extremely safe investment because of its historical stability. It’s also seen as a hedge against inflation and currency devaluation during periods of economic uncertainty.

Platinum mining is more expensive than gold mining and is concentrated in a few countries, such as South Africa, Russia, and Canada. and this makes it more vulnerable to political affairs and geopolitical and labor disruptions.

Gold is more widely available and can be mined in many countries around the world, making it less vulnerable to supply disruptions, labor disputes, and geopolitical conflicts.

Gold is particularly attractive right now because it doesn’t depend on the government or centralized financial institutions, at least as much as most other investments.

Gold is additional and traditional storage for value and investment assets and has been used as a currency for thousands of years, approximately as early as 5000 BC in Egypt. It’s long history of serving as most safe investment In times of economic instability makes it the best choice for investors around the world.

Gold is more commonly used in jewelry, which can make up a significant portion of its demand. This can make gold more stable than that platinum when it comes to platinum vs. gold Investments.

It has a long history of being a haven investment offering much-needed and welcomed diversification during economic unpredictability.

Gold More Commonly Used in Jewelry

Gold is more commonly used in jewelry, which can make up a significant portion of its demand.

Two very popular metals used in making rings, particularly wedding and engagement rings, are platinum and gold. Both these metals make lovely rings. Both can be shaped into intricate and detailed designs. Those aspects aside, the differences between the two become more apparent when compared.

Most platinum used in jewelry making is 950 grade, which translates to 95% platinum and 5% alloy, such as iridium or ruthenium. Because platinum is such a hard metal, using an alloy makes it possible to shape the metal into jewelry.

Ultimately, both gold and platinum have their unique advantages as investment options. While gold is a traditional safe haven asset with a long history of stability, platinum offers exposure to unique industries and potentially greater returns due to its volatility.

The choice between silver and platinum as an investment depends on numerous factors, including your financial goals, risk tolerance, market conditions, and more. Platinum is often priced higher than gold due to its rarity, but silver is more affordable for investors on a modest budget.

Gold vs Silver

Similar to gold, investors may hold on to silver for its role as a “safe haven” asset. Pros: Silver has a long track record of being a store of value. Investors view it as a hedge of protection against inflation and economic uncertainty.

Gold is one of the most traded investments to date, and probably what most people think of when investing in precious metals. Gold is rare and valuable, but it’s important to consider the possible downsides of investing in it too. Investing in gold has historically been the standard when it comes to preserving the value of your money against inflation. Inflation, or the gradual rise in prices in the economy over time, has reached drastic heights,

Silver is a popular precious metal investment that is often considered a hedge against uncertainty for its ability to hold its value over time during various economic conditions. Similar to gold, investors may hold on to silver for its role as a “safe haven” asset. Since silver is cheaper than gold, it is thought to be a more affordable and accessible precious metal investment. Silver is able to accommodate a wide range of investor goals.

Gold has a long history of serving as a most safe investment in times of economic instability. It is widely available and is mined in many countries of the world, making it less vulnerable to supply disruptions, labor disputes, and geopolitical conflicts.

If you want to read more about gold and investing in the precious metal, click here.

Check out daily gold rates here.

Follow INCPAK on Facebook / Twitter / Instagram for updates.