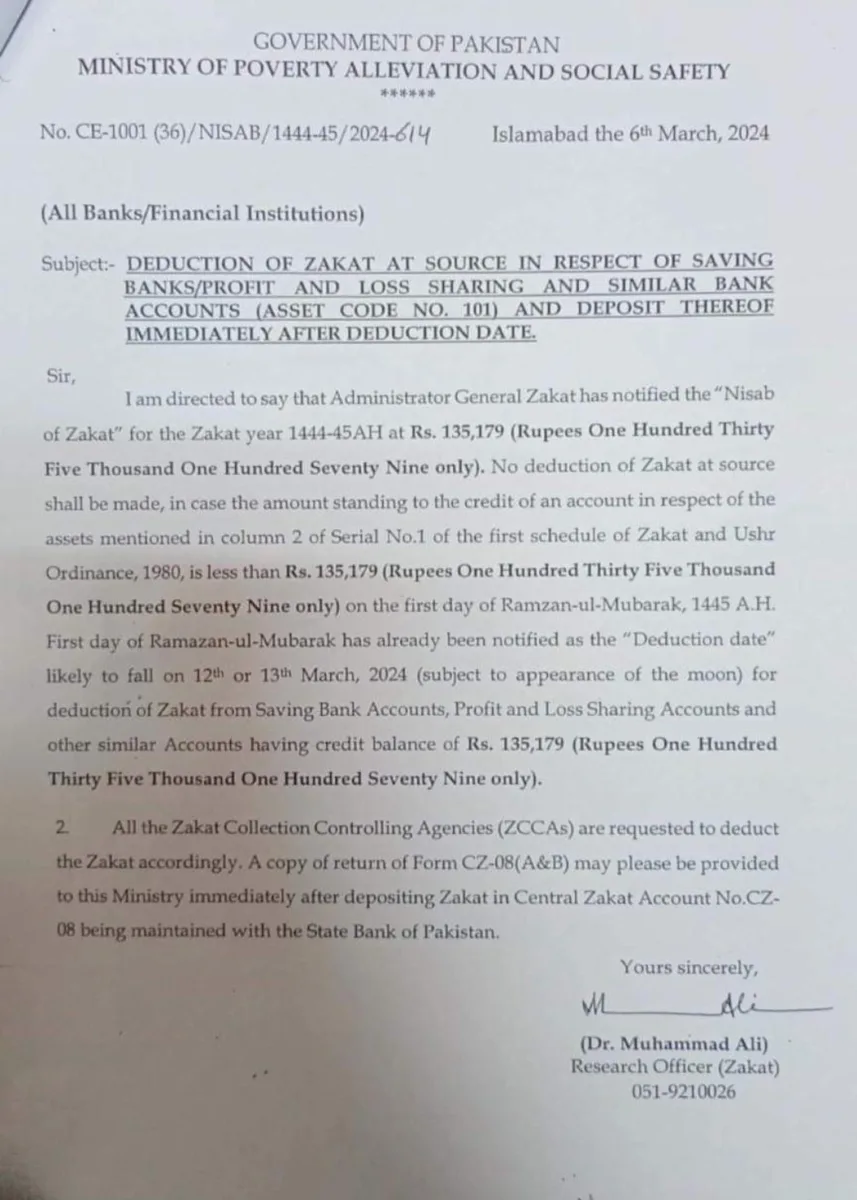

In a recent announcement, the Administrator General Zakat revealed the Nisab of Zakat for the upcoming Zakat year 1444–45 A.H., setting the minimum threshold at Rs 135,179. This crucial figure serves as a benchmark for determining whether individuals are obligated to contribute to Zakat, a mandatory form of charity in Islam.

According to the Zakat and Ushr Ordinance of 1980, no Zakat deduction at source will be enforced if the account balance remains below this specified amount on the inaugural day of Ramzan-ul-Mubarak, 1445 A.H. This provision ensures that individuals with lesser financial means are not burdened with Zakat obligations, aligning with the principles of fairness and equity within the Islamic framework.

The designated “deduction date” has been officially designated as the first day of Ramzan-ul-Mubarak, anticipated to fall on 12 or 13 March 2024 (subject to the sighting of the moon). On this significant day, Zakat will be deducted from various financial instruments, including savings bank accounts, profit and loss sharing accounts, and similar accounts holding a credit balance of Rs 135,179 or above.

Zakat Collection Control Agencies (ZCCAs) have been duly instructed to carry out the deduction process by the prescribed guidelines. Subsequently, they are required to promptly furnish a copy of the return of Form CZ-08 (A&B) after depositing the collected Zakat into Central Zakat Account No.CZ-08, maintained with the State Bank of Pakistan. This meticulous procedure ensures transparency and accountability in the management of Zakat funds, thereby fostering trust and confidence among the Muslim community.

Follow INCPAK on | Facebook | Twitter | Instagram | for updates.