The Federal Bureau of Revenue (FBR) announced that sales tax will now be applicable on used cars according to the new taxation rules issued in statutory regulatory order (SRO 931 (I)/2020).

Under these new rules, the Federal Bureau of Revenue (FBR) will get 17 percent sales tax on used cars by traders on the differential amount between the sale and purchase value of the vehicle.

It is pertinent to mention that the sales tax on used cars goes up by 3 percent in case the trader is non filer. This is the very reason these new rules are being implemented as many dealers in Pakistan try to evade taxes.

Read more: Pay Vehicle Token Tax Online in Punjab.

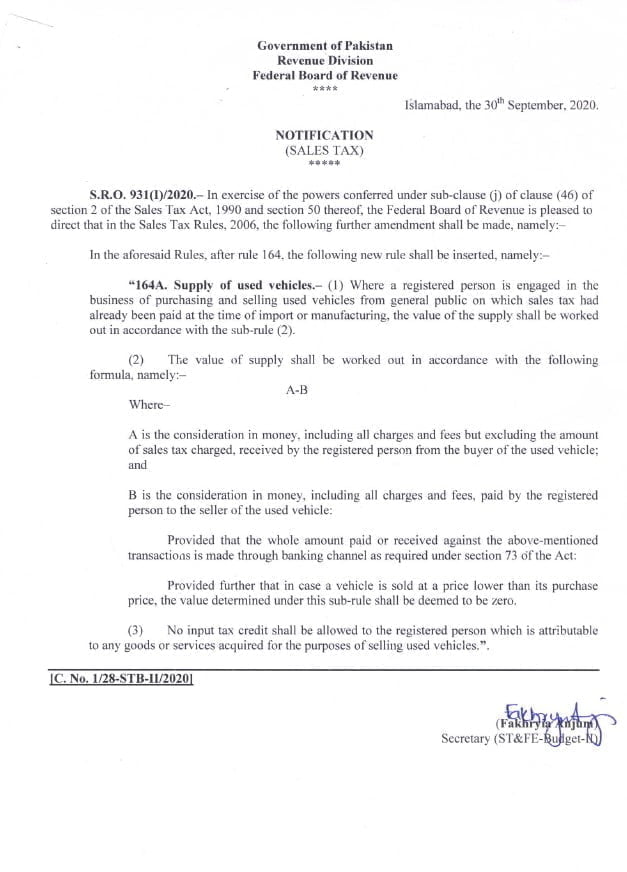

Furthermore, the new rules mentions, “Where a registered person is engaged in the business of purchasing and selling used vehicles from general public on which sales tax had already been paid at the time of import or manufacturing, the value of the supply shall be worked out in accordance with the ‘A-B formula”.

In this formula ‘A’ is the consideration in money, including all charges and fees but excluding the amount of sales tax charged, received by the registered person from the buyer of the used vehicle while ‘B’ is the consideration in money, including all charges and fees paid by the registered person to the seller of the used vehicle provided that the whole amount paid or received against the above mentioned transactions is made through banking channel as required under section 73 of the Act.

However, in case the vehicle is sold at a price lower than its purchase price, the value determined under this rule shall be deemed as zero. Furthermore, there will be no input tax credit allowed to the registered person which is attributable to any goods or services acquired for the purpose of selling used vehicles.

It is pertinent to mention that this new rule regarding payment of sales tax on used cars is valid for traders or businesses dealing with such vehicles and not individuals who sell or buy a vehicle for personal use.

Read more: Islamabad City App now provides Vehicle Token Tax payment online.