Islamabad Vehicle Token Tax Information by Excise & Taxation Department Islamabad, now you can pay Token Tax Online using Islamabad City app using your smartphone.

Public Announcement

![Motor Vehicle Token Tax Islamabad 2020 [Update]](https://i2.wp.com/www.incpak.com/wp-content/uploads/2020/07/75135947_3364772620221385_746709336989610686_o.jpg?fit=845%2C1024&ssl=1)

Islamabad Excise and Taxation Department Office Address

Deputy Commissioner Islamabad said “To resolve the problem of long queues on the collection of tokens of vehicles in Excise and Taxation Department Office and Islamabad Capital Territory (ICT) Administration has issued an order to keep the department opened from 9 am to 8 pm. Citizens can submit fee at the Excise office at any time throughout the day.”

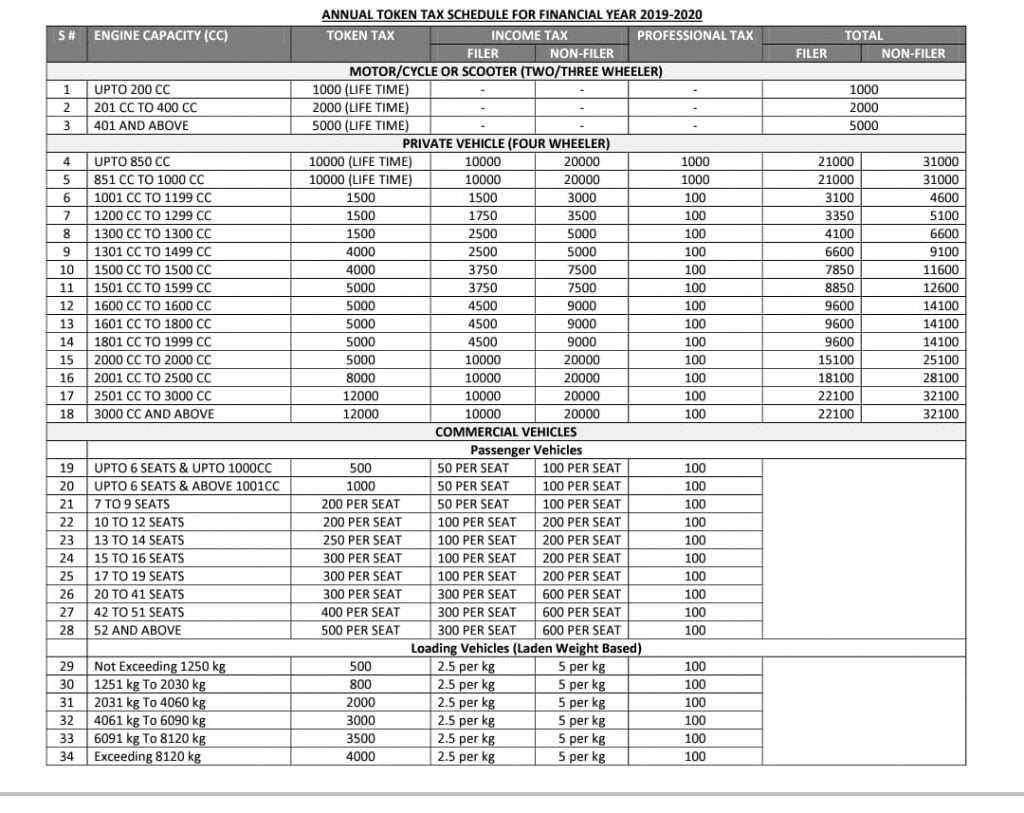

We at Independent News Coverage Pakistan (INCPAK) been receiving your emails regarding Token Taxes, how much you have to pay so here’s the chart below which will help you understand.

Pay Sindh Registered Motor Vehicle Token Tax Online

A similar system has been introduced by Excise & Taxation Department Sindh to pay Vehicle Tax/Token Tax online, we have briefly mentioned the steps how to pay your vehicle’s token tax online and by visiting the nearest National Bank of Pakistan (NBP) Branches.

Pay Motor Vehicle Token Tax Sindh [Complete Guide]

Pay Punjab Registered Motor Vehicle Token Tax Online

Excise & Taxation Department of Punjab has introduced an Online system to pay Motor vehicle token tax online, we have gathered the information to make it more convenient for us visitors to understand how to pay the token tax amount online.

Islamabad Token Taxes 2020-2021

Taxes information on Islamabad registered vehicles is here. Taxes include Motor Vehicle Registration fee, ADVANCE TAX – NEW VEHICLES, Motor Vehicle Transfer fee, Token fee, income tax, Luxury Tax, Fee of Choice Number Plates. Check taxes on every type of vehicle here.

REGISTRATION FEE

| Vehicle Category | Engine Capacity | Value of vehicle |

| Private / Government | 999 cc and Below | 01 % |

| Private / Government | From 1000 cc to 1999 cc | 02 % |

| Private / Government | 2000 cc and Above | 04 % |

| Commercial | 999 cc and Below | 01 % |

| Commercial | 1000 cc and Above | 02 % |

ADVANCE TAX – NEW VEHICLES

| Engine Capacity | Filer (In Rs.) | Non-Filer (In Rs.) |

| Upto 850 cc | 10,000 | 20,000 |

| From 851 cc to 1000 cc | 20,000 | 40,000 |

| From 1001 cc to 1300 cc | 30,000 | 60,000 |

| From 1301 cc to 1600 cc | 50,000 | 100,000 |

| From 1601 cc to 1800 cc | 75,000 | 150,000 |

| From 1801 cc to 2000 cc | 100,000 | 200,000 |

| From 2001 cc to 2500 cc | 150,000 | 300,000 |

| From 2501 cc to 3000 cc | 200,000 | 400,000 |

| Above 3001 cc | 250,000 | 500,000 |

ADVANCE TAX – ON TRANSFER

| Engine Capacity | Filer (In Rs.) | Non-Filer (In Rs.) |

| Upto 850 cc | NIL | NIL |

| From 851 cc to 1000 cc | 5,000 | 10,000 |

| From 1001 cc to 1300 cc | 75,00 | 15,000 |

| From 1301 cc to 1600 cc | 125,00 | 25,000 |

| From 1601 cc to 1800 cc | 18,750 | 37,500 |

| From 1801 cc to 2000 cc | 25,000 | 50,000 |

| From 2001 cc to 2500 cc | 37,500 | 75,000 |

| From 2501 cc to 3000 cc | 50,000 | 100,000 |

| Above 3001 cc | 62,500 | 125,000 |

TOKEN TAX

| Vehicles Catagories | Engine Capacity/Seats | Amount (in Rs.) |

| MOTORCYCLE AND SCOOTER (Two/Three Wheeler Vehicles) | ||

| Motorcycle/Scooter | Upto 200 cc | 1,000 (Lifetime) |

| —— | 201 cc to 400 cc | 2,000 (Lifetime) |

| —— | 401 cc and Above | 5,000 (Lifetime) |

| FOUR WHEELER VEHICLES | ||

| Private / Government | Upto 1000 cc | 10,000 (Lifetime) |

| —— | From 1001 cc to 1300 cc | 1,500 |

| —— | From 1301 cc to 1500 cc | 4,000 |

| —— | From 1501 cc to 2000 cc | 5,000 |

| —— | From 2001 cc to 2500 cc | 8,000 |

| —— | From 2501 and Above | 12,000 |

| COMMERCIAL VEHICLES | ||

| MOTTOR CAB Having Upto 6 Seats | Upto 1000 cc | 600 |

| —— | From 1001 cc and Above | 1,000 |

| Public Service Vehicles | From 8 Seats to 12 Seats | 200 Per Seat |

| —— | From 13 Seats to 14 Seats | 250 Per Seat |

| —— | From 15 Seats to 16 Seats | 300 Per Seat |

| —— | From 17 Seats to 41 Seats | 300 Per Seat |

| —— | From 42 Seats to 51 Seats | 400 Per Seat |

| —— | From 52 and Above | 500 Per Seat |

| Loading Vehicles / Goods Vehicles | Laden weight not exceeding 1250 kg | 500 |

| —— | Laden weight exceeding 1250 kg but not exceeding 2030 kg | 800 |

| —— | Laden weight exceeding 2030 kg but not exceeding 4060 kg | 2,000 |

| —— | Laden weight exceeding 4060 kg but not exceeding 6090 kg | 3,000 |

| —— | Laden weight exceeding 6090 kg but not exceeding 8120 kg | 3,500 |

| —— | Laden weight exceeding 8120 kg | 4,000 |

INCOME TAX

| Vehicle Catagory | Engine Capacity | Filer (in Rs.) | Non-Filer (in Rs.) |

| Private | Upto 850 cc | 10,000 | 20,000 |

| Private | From 851 cc to 1000 cc | 10,000 | 20,000 |

| Private | From 1001 cc to 1199 cc | 1,500 | 3,000 |

| Private | From 1200 cc to 1299 cc | 1,750 | 3,500 |

| Private | From 1300 cc to 1499 cc | 2,500 | 5,000 |

| Private | From 1500 cc to 1599 cc | 3,750 | 7,000 |

| Private | From 1600 to 1999 cc | 4,500 | 9,000 |

| Private | From 2000 and Above | 10,000 | 20,000 |

| Commercial | loading Pickup/Mini Truck/Truck | Rs. 2.50 per Kg | Rs. 5.00 per Kg |

| Commercial | Pessenger Vehicle (Upto 9 Seats) | 50 per Seat | 100 per Seat |

| Commercial | Pessenger Vehicle (10 to 19 Seater) | 100 per Seat | 200 per Seat |

| Commercial | Pessenger Vehicle (20 & More Seater) | 300 per Seat | 600 per Seat |

TRANSFER OF OWNERSHIP FEE

| Vehicle Category | Engine Capacity | Amount (In Rs.) |

| Private / Commercial | Upto 1000 cc | 1,200 |

| Private / Commercial | From 1001 cc to 1800 cc | 2,000 |

| Private / Commercial | Above 1801 cc | 3,000 |

HPA FEE

| Vehicle Category | Engine Capacity | Amount (In Rs.) |

| Private / Commercial | Upto 1000 cc | 1,200 |

| Private / Commercial | From 1001 cc to 1800 cc | 2,000 |

| Private / Commercial | Above 1801 cc | 3,000 |

HPT FEE

| Vehicle Category | Engine Capacity | Amount (In Rs.) |

| Private / Commercial | Upto 1000 cc | NIL |

| Private / Commercial | From 1001 cc to 1800 cc | NIL |

| Private / Commercial | Above 1801 cc | NIL |

PROFESSIONAL TAX

| Vehicle Category | Amount (in Rs.) |

| Commercial loading Pickup | 100 |

| Commercial Mini Truck / Truck | 100 |

LATE FEE

| Time Period (Staring from invoice date/Bill of Entry date/Auction date) | Amount (in Rs.) |

| More than 02 months (60 days) and less than 06 months (180 days) | 2,000 |

| More than 06 months (180 days) | 5,000 |

SPECIAL NUMBER FEE

| REGISTRATION NUMBERS | Amount (in Rs.) |

| MOTORCYCLE (PRIVATE) | |

| 001, 005, 007, 123, 125, 786 | 5,000 |

| 002, 003, 004, 006, 008, 009 | 1,000 |

| 011, 022, 033, 044, 055, 066, 077, 088, 099 | 500 |

| 111, 222, 333, 444, 555, 666, 777, 888, 999 | 1,000 |

| FOUR WHEEL VEHICLE (PRIVATE) | |

| 001 | 300,000 |

| 786 | 150,000 |

| 005, 007, 111, 555, 777 | 100,000 |

| 002, 003, 004, 006, 008, 022, 033, 044, 066, 077, 088, 099 | 26,000 |

| 222, 444, 666, 888 | 40,000 |

| 022, 033, 044, 066, 077, 088,099 | 26,000 |

| 010, 011, 012, 014, 055, 072, 092, 110, 313, 512, 514, 572, 333, 999 | 40,000 |

| 101, 200, 300, 400, 600, 700, 800, 900, 123 | 20,000 |

| 100, 500, 009 | 30,000 |

| REMAINING TWO DIGIT NUMBERS (i.e, 023, 043, 080, 093 etc.) | 5,000 |

NUMBER PLATES FEE:

| Vehicle Category | Amount (in Rs.) |

| Motor Cycle (Government) | 400 |

| Motor Cycle (Private) | 400 |

| Four Wheel Vehicle (Government) | 800 |

| Four Wheel Vehicle (Private & Commercial) | 800 |

NOTE:

- MUTUAL TRANSFER FEE: Rs. 100/- Each

- DUPLICATE / REPLACEMENT CERTIFICATE FEE: Rs. 500/- (Private / Government), Rs. 1000/- (Commercial).

- ALTERATION FEE: Rs. 1,500/-

- CHANGE OF TITLE FEE: Rs. 400/-

- RESIDENT PROOF FEE: Rs. 100/-

- SMART CARD FEE: Rs. 1,462/-

All information about the vehicle tax of Islamabad is stated above. You can also visit the official site of Islamabad Excise & Taxation Department’s official website..

Islamabad City App now provides Vehicle Token Tax Payment

Private and Commercial vehicles and Filers and Non-Filers both are mentioned for more queries kindly visit Excise and Taxation Department Islamabad.

DOWNLOAD VEHICLE VERIFICATION SMARTPHONE APP

INCPak Technologies (INCPAK TECH) also Introduces – Vehicle Verification Online Smartphone application, Download from Google Playstore now. Tax information and online verification are available theirs also. Download from the link given below.