ISLAMABAD: The Federal Board of Revenue -FBR- is taking immediate steps for broadening of Tax Base in the country.

AT the same it will be taking measures to decrease the unnecessary tax burden on the general public.

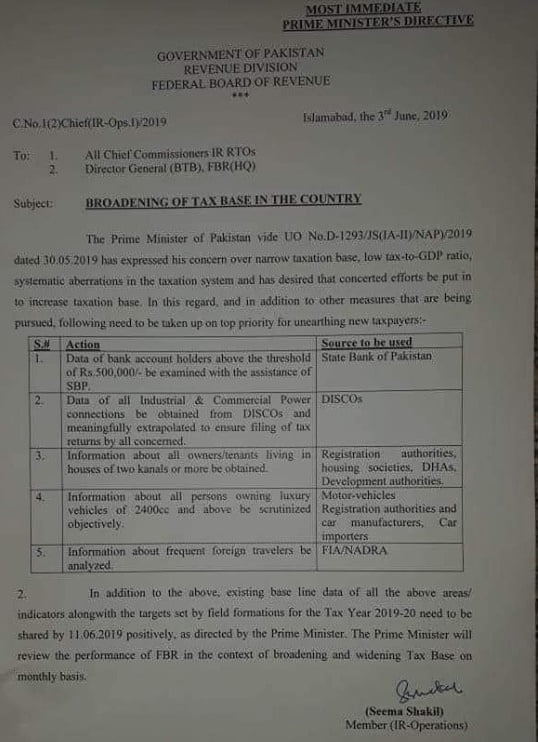

The Prime Minister of Pakistan, Imran Khan through LIO No. D-1293/JS(IA-II)/NAP/2019 dated 30 May 2019 has expressed is concern over :

- Narrow taxation base

- low tax-to GDP ratio

- Systematic aberrations in the taxation system

The PM Imran Khan has also expressed his desire to increase taxation base through collective efforts.

Measures are already being taken in this regards.

READ MORE: Golra Rape Case: Brothers Demand Forgiveness For Raping Sister

In addition following needs to be taken on top priority.

- Accounts over the threshold of PKR 500,000/- will be examined with the assistance of SBP.

- To ensure filing of tax returns by all Industrial and Commercial Power Connections data will be obtained from DISCos.

- Information of all owners and tenants living in the houses of two or more kanals will be obtained from registration authorities, housing societies, DHAs, Development authorities.

- Information of owners of luxury vehicles of 2400cc and above will also be scrutinized.

- The frequent travellers will also be analyzed.

Broadening of Tax Base in The Country by FBR

Broadening of Tax Base in The Country

READ MORE: Justice For Jamna: Minor Girl Gang Raped in Sindh

Highlights of New Taxes

- Unregistered industrial/commercial entities (not having STRN) having electricity/gas bill amount in excess of Rs 20,000 per month, the extra sales tax would be increased from 5% to 20%

- Residential consumers are made liable to provide NTN in case electricity bill amount exceeds Rs 1.2 million per year or levy advance income tax withholding of 20%.

- All exemptions (like exemption on agricultural income) under the Income Tax Law should only be made available to filers so that exempt income is also reported and wealth is reconciled with income reported in the return.

- Withholding tax on International business class tickets under section 236L is same Rs 16,000 for filer and non-filer, it would be increased to Rs 50,000 for non-filers.

- Withholding income tax on interest income u/s 151 is 10% for filer and 17.5% for non-filer. Rate would be increased to 30% for non-filers.

- Annual private motor vehicle tax u/s 234 for non-filers is Rs 30,000 for 2000 CC and above. The rate for non-filers would be increased to Rs 200,000 for 2000 CC and above.

- Rate of income tax on Filer as well as Non-Filer Commercial / industrial connections of electricity is 12% and 5% respectively. Rate of tax for Non Filer Commercial / industrial connections would be increased to 25%

- At present, 12% WHT is being collected from owners of marriage halls on their electricity bills, which does not represent actual tax on their income. Moreover, the same is somehow minimized through use of generators. In order to avoid this, Capacity Tax would be imposed on marriage halls on the basis of per square feet coverage area.

List of registered Marriage halls paying capacity tax on per square foot basis would be on internet and accessible to all so that it can easily be identified who is not on the list thereby forcing them to get themselves register and pay tax. - Tax on capital gain on disposal of shares of Listed Company is 15% for Filers and 20% for Non-Filers. Rate of tax for Non-Filers would be increased to 30%

- List of top 100 restaurants registered in Federal / Provincial sales tax with the amount of tax paid, would be on the internet access to all so that famous busy restaurants who are not on this list or on bottom of the list are induced not to embarrass themselves by declaring low sales.

The lottery system is introduced for invoice collected by customers of restaurants and uploaded on a designated website. Moreover, invoices submitted by customers should be cross-checked with invoices reported by restaurants in their monthly sales tax return. - Advance tax 1% and 2% is collected from filer and non-filers respectively on sale of immovable property. For sale of land above 250 square yards, rate of advance tax would be increased to 10%

- In addition to above-referred tax, the real estate constructors should pay additional withholding tax when they get the constructed property registered in the name of buyers of their constructed property. This would be inline with withholding taxes imposed on industries on transactions executed by them.

- Purchase of land (above specified limit) is only allowed by filers, however, the holding of land and its sale by non-filers is still allowed. Holding of land by non-filers should be made more expensive by asking authorities collecting property tax (cantonment boards / societies / registrar) to collect adjustable advance income tax, from non-Filers, on behalf of the Federal Government as follows:

- a) Rs 500,000 per year for 800 yards or more but less than 1800 yards.

b) Rs 1 million per year for 1800 yards and above.

c) So that such property comes for sale. - Currently, advance income tax on international travel is being collected as follows, which would be increased as follows:

a) First / Executive class – Rs 16,000 be increased to Rs 35,000 for Non-Filers

b) Other excluding Economy class – Rs 12,000 be increased to Rs 20,000 for Non-Filers

c) Economy class – No tax is being collected on economy class tickets. To allow data mining, marginal withholding tax (say Rs 200 – 500) would be imposed on Non-Filers just to gather data of frequent travelers. - mobile phone connection should only be available to Filers per CNIC

Follow INCPAK on Facebook / Twitter / Instagram for updates.