Ehsas Interest-Free Loan program has helped many poor and needy people throughout the country to stand on their feet and earn their daily bread. The National Poverty Graduation Initiative (NPGI) is part of Ehsaas strategy to help the poorest household out of poverty and set them on the course of independence and economic wellbeing.

Dr. Sania Nishtar in a series of tweets has thrown some light on the progress and achievements of the Ehsas Interest-Free Loan. She had been busy taking reviewa on the progress and performance of the Ehsas Interest Free Loan Program.

She informed through her tweet that the government has allocated an additional amount of Rs. 5 billion into the budget and 28 more districts are being added to it.

Tweets by Dr. Sania Nishtar

Today I held a review meeting with Ehsas Partners PPAF to review the performance of the Ehsas Interest-Free Loan Program. Recently, the government allocated an additional Rs. 5 billion to expand the scope of the program to 110 districts. 28 more districts are being added to it.

Since July 2019, small business loans worth over Rs. 45.8 billion have been issued to more than 1.3 million people under the Ehsas interest-free loan program in 110 districts of the country. 46% of loans have been given to women.

In 110 districts of the country, the areas for which interest-free loans have been issued include trade, livestock and poultry, sewing, embroidery and embroidery, services, agriculture, and manufacturing.

Bakhtan Mai of Muzaffargarh has opened a small pottery factory with an interest-free loan, where she and her family make pottery. His monthly income is Rs. 15,000

Muhammad Irshad of Mansehra District has expanded his slippers business through Ehsas interest free loan. He is easily supporting his family from this business

Noor Mohammad hails from Pishin district of Balochistan. He has opened a mobile shop with an interest free loan. He is very happy with his business

Asudi hails from Thatta and her husband farms. She bought goats through an interest-free loan. She has twice taken an interest-free loan. The number of their goats is now 5.

Salient Features of Interest Free Loan Programme

• Interest Free loans for income generating micro-enterprises

• Funding through Federal & Provincial Governments

• Allocation of Rs. 5 billion additional funds for FY 2019-20 by Federal Government

• Loan size up to Rs. 75,000 (Average Loan size: Rs.30,0000)

• 50% loans for women

• Financial inclusion & mainstreaming of marginalized segments of society especially skilled youth, women, persons with special abilities transgender people, BISP, Zakat & Baitul Mal beneficiaries.

• Business advisory services and linkages with MFIs, MFBs & Banks

• Disbursement of 80, 000 loans every month through 1110 loan centers of PPAF Partners, including

Akhuwat Organizations (POs) across the country

Eligibility Criteria of Borrowers

• Age been 18 to 60 years

• Individuals from households on Score of 0-40 on Poverty Score Card

• Valid National Identity Card (CNIC)

• Resident of targeted union council of the district

• Economically viable business plan

Where to Apply for Interest Free Loans

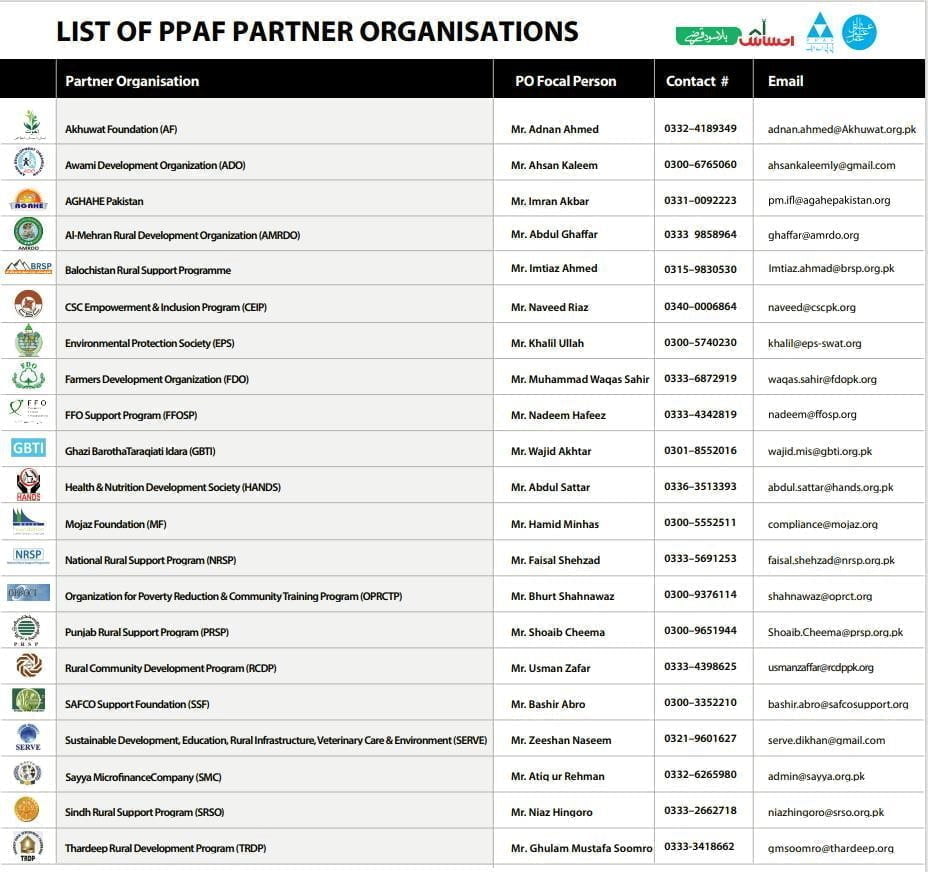

The interest Free Loan Programme is being implemented through 22 Partner Organizations (POs) of

loan centers in 100 districts across the country. The information for districts, loan centers, names of

implementing Partner Organizations (POs) and eligibility criteria for potential borrowers is provided at;

www.ppaf.org.pk/NPGI.htmApplication Process

Application Process

- Request at loan center (written or oral)

- Verification of Poverty Score Card.

- Registration as a potential borrower

- Issuing of application form and business plan form

- Submission of complete documents by the applicant

Preparation of Business Plan

- Collect basic information about the business which is being initiated

- Reasons for business

- Targets of production and sale

- Marketing strategy

- Business expenses

- Cost estimation for the proposed business

- Financial resources

- Estimation of profit

Beneficiary Appraisal Process

- Social Appraisal

- Economic Appraisal

Approval Process for Loan

- Review by Loan Center

- Recommendation by Loan Center

- Submission of recommended cases to PO head office

Disbursement to Beneficiary

• Approval of recommended cases

• Issuance of order cheques carrying names and CNIC of the borrowers or issuance of PIN number against electronic transfer that is verified by the bank through original CNIC

• Disbursement at Loan Cente

Contact

For more information on the Interest Free Loan programme contact here

Mr. Farid Sabir

General Manager

Interest-Free Loan Programme

0300-5016963

Mr. Shafqat Aziz

Communications & Media Officer

0300-5016957

Important Links

- List of Loan Centers

- List of PPAF Partner Organizations

- Interest-Free Loan Programme

- Interest-Free Loan program in Urdu

- PPAF

- NPGI

READ MORE: How to Avail Ehsaas Interest-Free Loan, Eligibility, Loan Centers

Follow INCPAK on Facebook / Twitter / Instagram for updates.