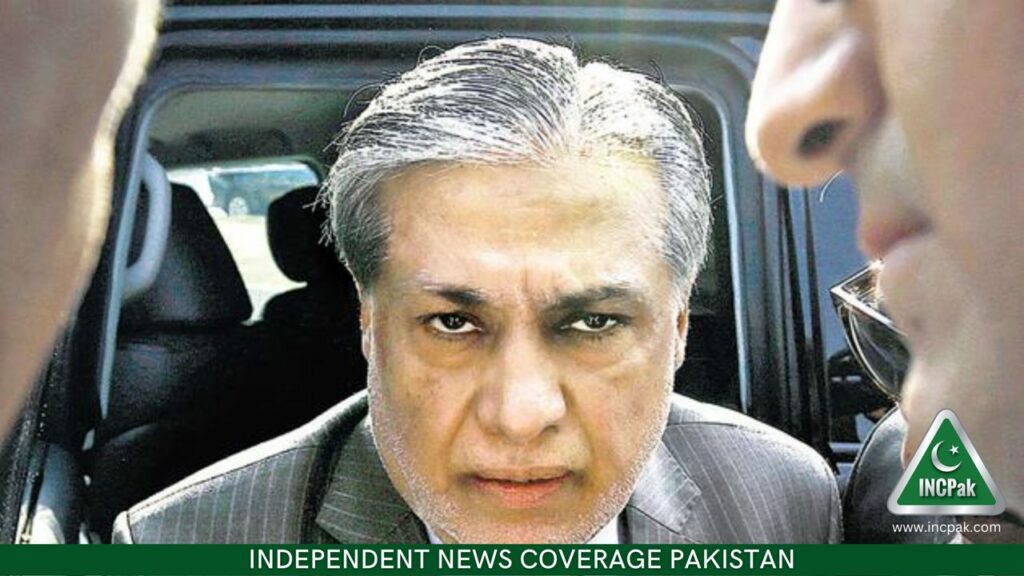

The Federal Minister for Finance and Revenue, Senator Ishaq Dar, on Wednesday presented the Finance (Supplementary) Bill 2023 (aka Mini-Budget) in the National Assembly in order to meet the conditions of the International Monetary Fund (IMF) to continue the loan programme.

During his address to the lower house of parliament, the Finance Minister announced an increase in the General Sales Tax (GST) on all products from 17% to 18% and increased the Federal Excise Duty (FED) on cigarettes as well.

It is pertinent to mention that increase in General Sales Tax (GST) to 18% and hike in the Federal Excise Duty (FED) on cigarettes has already been implemented as of 15 February 2023 and a notification has been issued by the Federal Board of Revenue (FBR).

The move will help the Federal Government raise in additional Rs. 170 billion to correct the budget deficit as per IMF demand.

Furthermore, the mini-budget proposed an increase in the Federal Excise Duty (FED) on fizzy drinks (aka soft and sugary drinks). However, the mini-budget proposed for GST not to be imposed on essential goods like wheat, rice, milk, pulses, vegetables, fruits, fish, eggs or meat.

Moreover, the Federal Government has increased the Federal Excise Duty (FED) on cement and also raised the FDE on business and first-class air tickets to now be Rs. 20,000 or 50%, whichever is higher.

In order to help the poor segment of society, the Federal Government has raised the budget for the Benazir Income Support Program (BISP) from Rs. 360 billion to Rs. 400 billion.

Additionally, the Government has announced to raise the General Sales Tax (GST) on luxury items from 17% to 25%, while 10% withholding adjustable income tax has been imposed on marriage halls.

Read more: Petrol Prices in Pakistan May Get Huge Increase For Fortnight.

Follow INCPAK on Facebook / Twitter / Instagram for updates.